1. Guide to the Australian payments system

2. Payments system at a glance

- Accessing the payments system

4. Point of sale (POS) technology

6. High-value payments

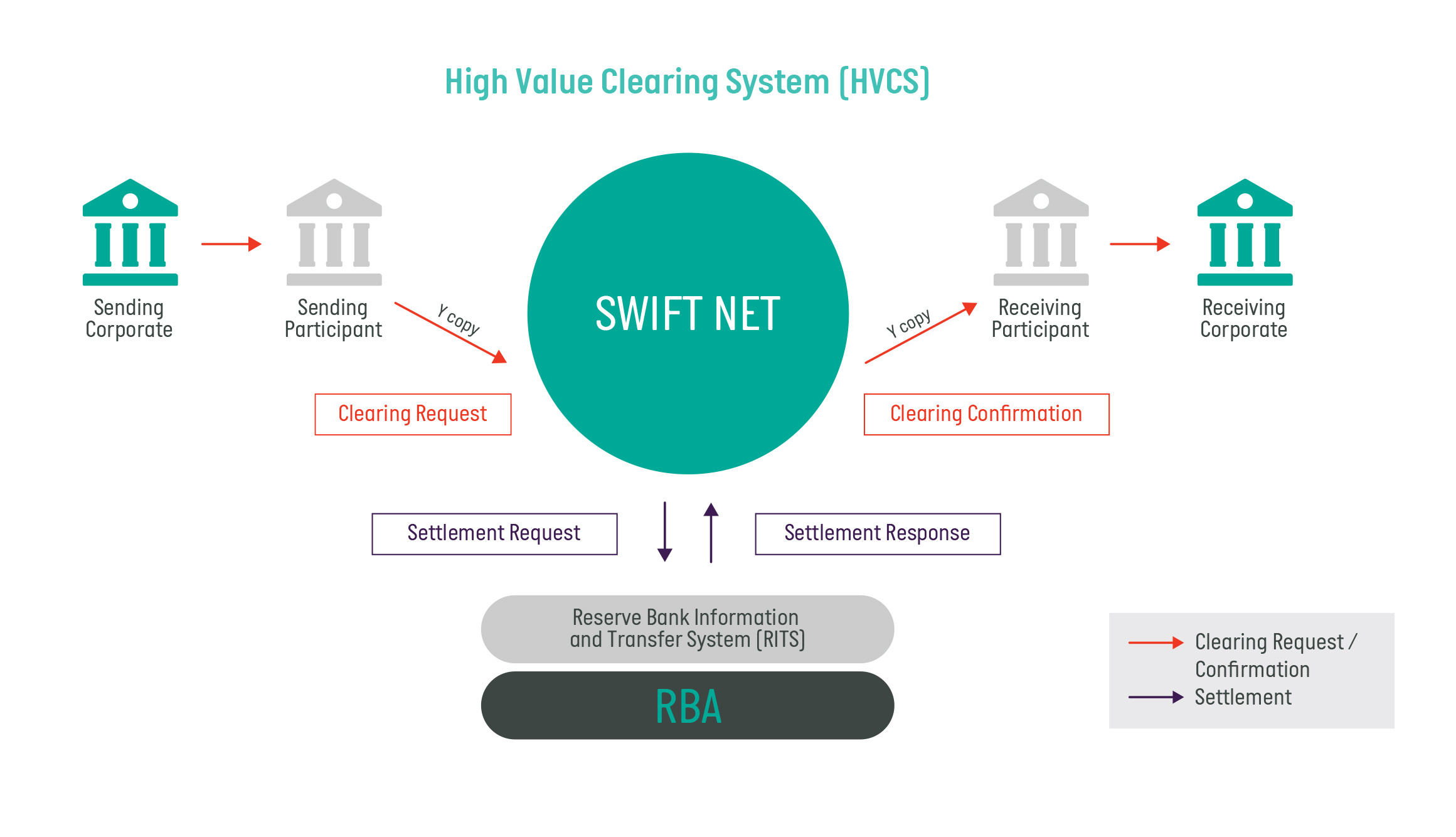

The High Value Clearing System (HVCS) is used to clear and settle large value payments in real-time. With no upper value transaction limit, this system accounts for roughly 90% of the value of all transactions in Australia. High-value payments are usually made between financial institutions or large corporates, and are irrevocable.

The system supports two types of payments:

- Single Customer Credit Transfers – for customers as beneficiary, denoted as MT103 Swift transfers

- General Financial Institution Transfers – bank-to-bank payments, denoted as MT202 Swift transfers

Governance of High-Value Payments

AusPayNet’s HVCS Committee governs the high value system. It maintains HVCS rules and regulations, deals with operational considerations and oversees industry change initiatives.

The RBA manages the RITS system underpinning settlement of high-value payments.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT), while not a payment system, provides critical services to RITS. SWIFT provides communications services to facilitate the transfer of payment and other information between participants in the financial system. As the HVCS runs on a SWIFT payment delivery system (PDS), participants must also be members of SWIFT1.

HVCS participants are allocated a SWIFT code (also called a Bank Identifier Code (BIC)) for use in the system.

HVCS licensing

To make high-value transactions linked to an underlying customer bank account, participants may require an ADI license and/or an AFSL.

HVCS operations

Exchanges in the system occur among a specific user group within the SWIFT network administered by AusPayNet. Once participants have joined SWIFT, AusPayNet facilitates their entry into the user group.

Participants send payments, using SWIFT messages, to beneficiary banks via the SWIFT network. SWIFT simultaneously sends a settlement message directly (Y Copy in the diagram) to RITS and settlement occurs when funds are moved between ESAs. Only then, once settlement occurs, is a confirmation message sent via SWIFT to the beneficiary bank, completing the clearing process. Funds are released to the beneficiary account on the same day.

------------

1 This membership requirement is authorised by the ACCC.

High Value Clearing System (HVCS)

Processing high-value transactions

In most cases, high-value transactions are processed by commercial or institutional banks. The transactions may link to an underlying corporate client account or the bank’s own account.

Considerations for direct participants

Direct HVCS participants are usually ADIs that can clear and settle directly with other direct participants through their own ESA. They manage all of the key relationships - technology, settlement and regulatory – required in conducting high-value payments.

Most HVCS participants are direct participants.

Direct participants first need to establish a relationship with SWIFT, and obtain a SWIFT BIC. They then apply to AusPayNet for membership of the HVCS. AusPayNet will make the new member’s BIC known to other HVCS participants so its transactions are recognised.

Direct participants must have an ESA with the RBA and maintain membership of its RITS system. They will need to adhere to the RBA’s rules around ESA holders and RITS membership.

Considerations for indirect participants

Under the indirect HVCS model, an indirect HVCS member can enter into a commercial agency agreement with another HVCS member to process high-value transactions on its behalf.

Services provided to indirect members under an agency arrangement include clearing and settlement. The RBA may require an indirect member to become a direct member if its transaction volumes become significant.

Other considerations

AusPayNet is leading work to migrate the messaging that underpins the HVCS to ISO 20022. This comes with the strategic opportunity to harmonise messaging formats across domestic high value payments, cross-border payments and real-time payments (NPP) to ensure interoperability. The coexistence period for HVCS's current MT messages and the new ISO 20022 messages will commence in November 2022 and end in November 2024.