1. Guide to the Australian payments system

2. Payments system at a glance

- Accessing the payments system

4. Point of sale (POS) technology

3. Card Payments

Payment cards are by far the most popular retail payment method in Australia. Most in-person card payments are ‘contactless’, online purchases are growing strongly, and in-app purchases are increasingly popular.

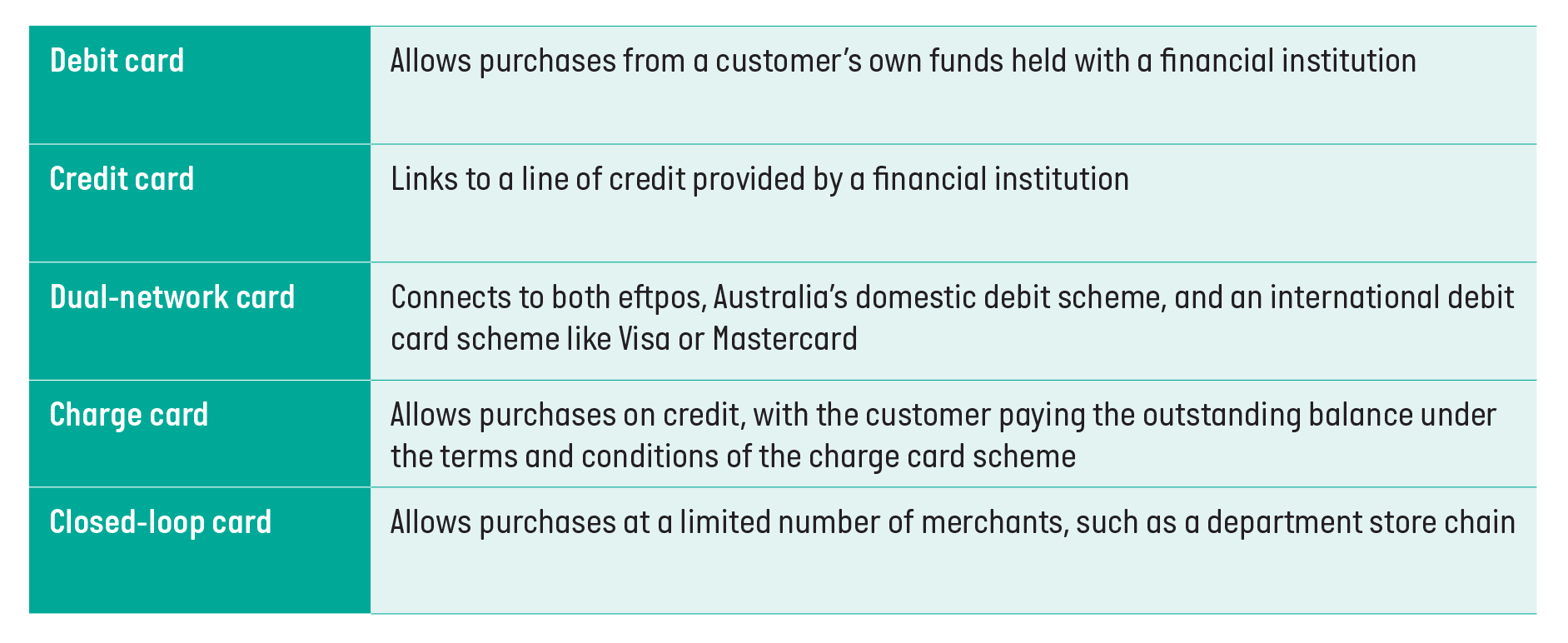

The various types of cards used are: In the card payments system, an ‘issuer’ is a financial institution that issues cards that access either a customer’s own funds (debit cards) or a line of credit (credit cards).

In the card payments system, an ‘issuer’ is a financial institution that issues cards that access either a customer’s own funds (debit cards) or a line of credit (credit cards).

An ‘acquirer’ is an entity that processes card transactions on behalf of merchants selling goods or services.

Four-party and three-party card schemes

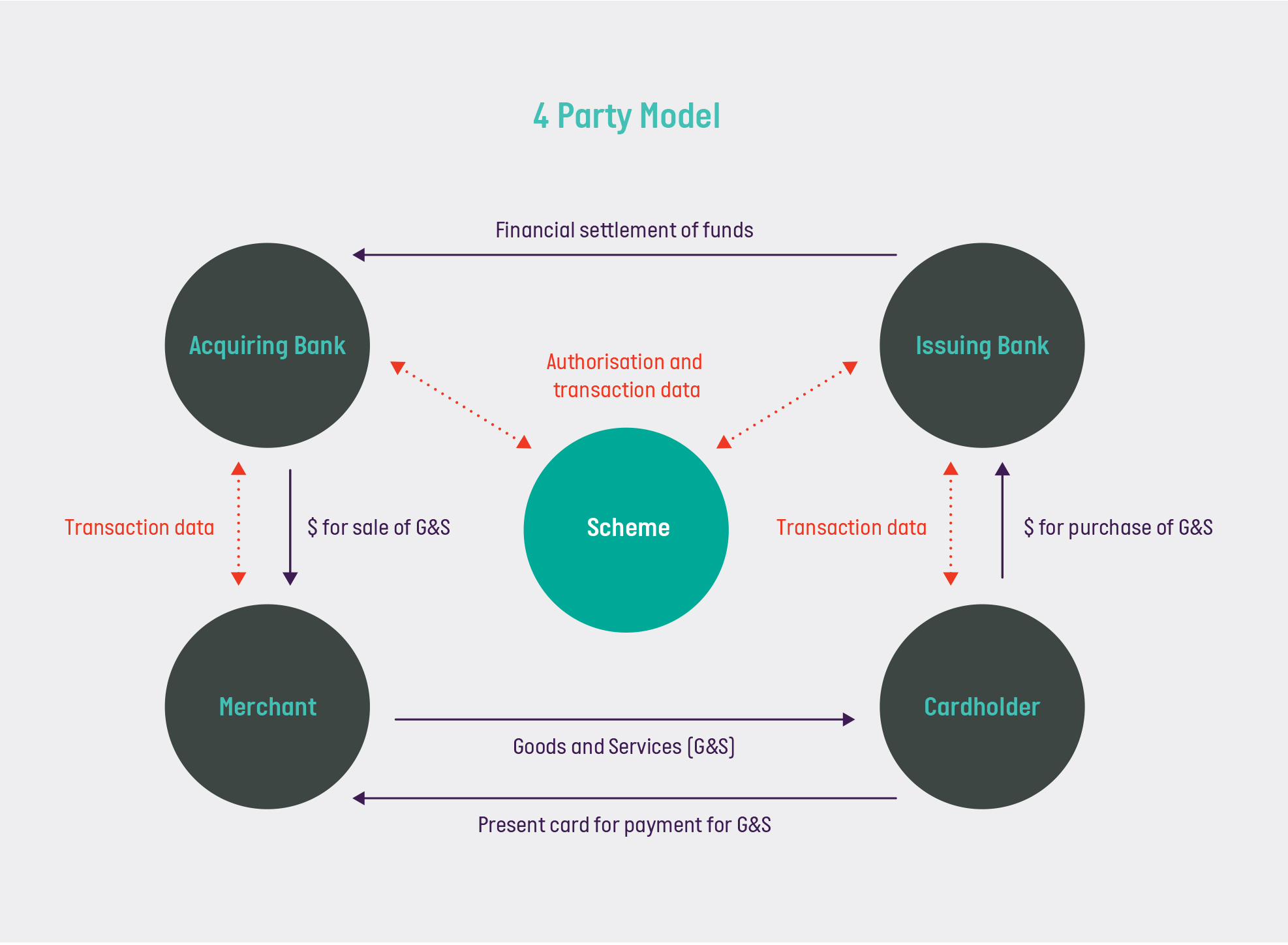

There are two card scheme models. The first, and more common, is the four-party model. Under this model, the card scheme works with both the financial institution who issues their cards to customers, and the acquirers who accept payments made on their cards.

| ▪ | Cardholder (an individual or business) |

| ▪ | Merchant (retailer or provider of goods or services) |

| ▪ | Issuer (usually a bank or financial institution, issuing the card to the cardholder) |

| ▪ | Acquirer (a financial institution or entity providing card payment services to the merchant) |

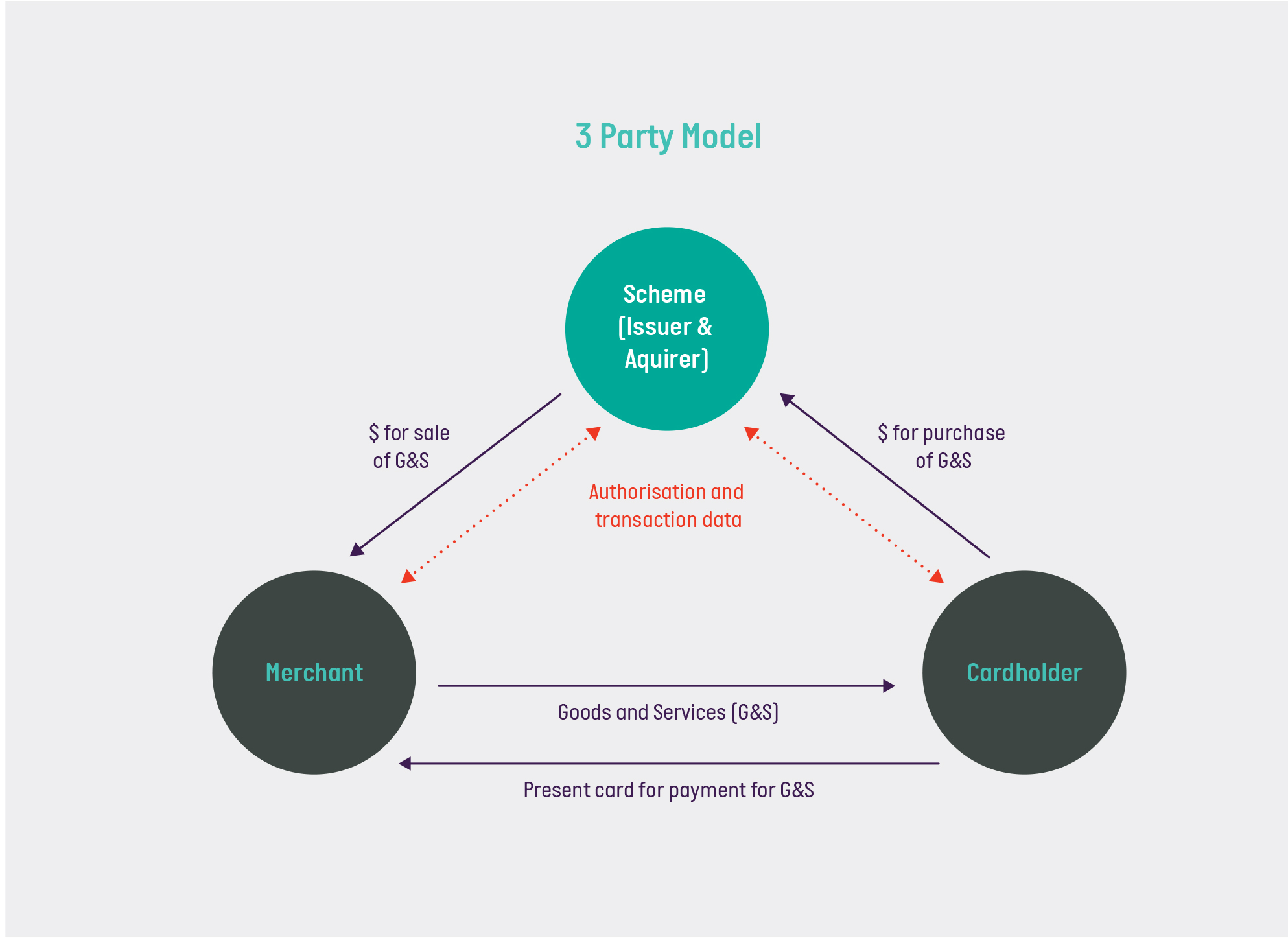

| ▪ | Cardholder |

| ▪ | Merchant |

| ▪ | Card scheme (acts as the acquirer to the merchant and issuer to the cardholder) |

Governance of card payments

Participants in card payments must follow the rules and guidelines of several organisations:

AusPayNet

The Issuers and Acquirers Community (IAC) administered by AusPayNet brings together a wide range of participants in the card payment system. The IAC Code Set establishes the governance framework for card payments and sets out the security and operational rules. These include processes for ATM and eftpos terminal evaluation and certification. To join the IAC, organisations have to meet certain membership criteria and are bound by the IAC rules.

The Card Schemes

Card Schemes set their own rules and requirements for issuers and acquirers using their networks.

Reserve Bank of Australia (RBA)

The RBA regulates interchange fees in the card system and merchants’ ability to surcharge (pass the cost of a transaction on to consumers).

Licensing requirements

Depending on their business model, card issuers and acquirers might need an ADI license, an AFSL and/or an ACL.