1. Guide to the Australian payments system

2. Payments system at a glance

- Accessing the payments system

4. Point of sale (POS) technology

5. Direct entry payments

The direct entry (DE) system (also known as the Bulk Electronic Clearing System, or BECS), is an efficient and reliable way of making low-value payments. Processing more than $10 trillion in 2019, BECS is the low-cost workhorse of the Australian payments system.

Australian businesses and government commonly use the system to make regular, automated payments to and from everyday transaction accounts. These include direct credit payments (for example, salary and welfare payments), direct debit payments (such as utility bills), and consumer ‘pay anyone’ bank transfers.

Participants in the DE system (BECS members), exchange bulk-payment instructions and settle their obligations through RBA Exchange Settlement Accounts (ESAs) five times each business day.

The bulk of DE payments are for smaller amounts but the system carries payments up to $100 million. Payments larger than that must be made using the high-value system.

The two types of direct entry transactions include:

Governance of DE payments

AusPayNet’s BECS Management Committee oversees the rules for:

- processing direct credit and debits

- sponsoring DE users into the system and allocation of unique identifier numbers through the BECS Connect platform

- administering the BSB system

- how BECS members deal with mistaken payments made by consumers

- account switching

The RBA manages the RITS system which underpins settlement for BECS.

DE Licensing requirements

Before an organisation can process direct debits or direct credits linked to an underlying transaction account, it will likely need an ADI licence from APRA and an AFSL licence from ASIC.

DE operations

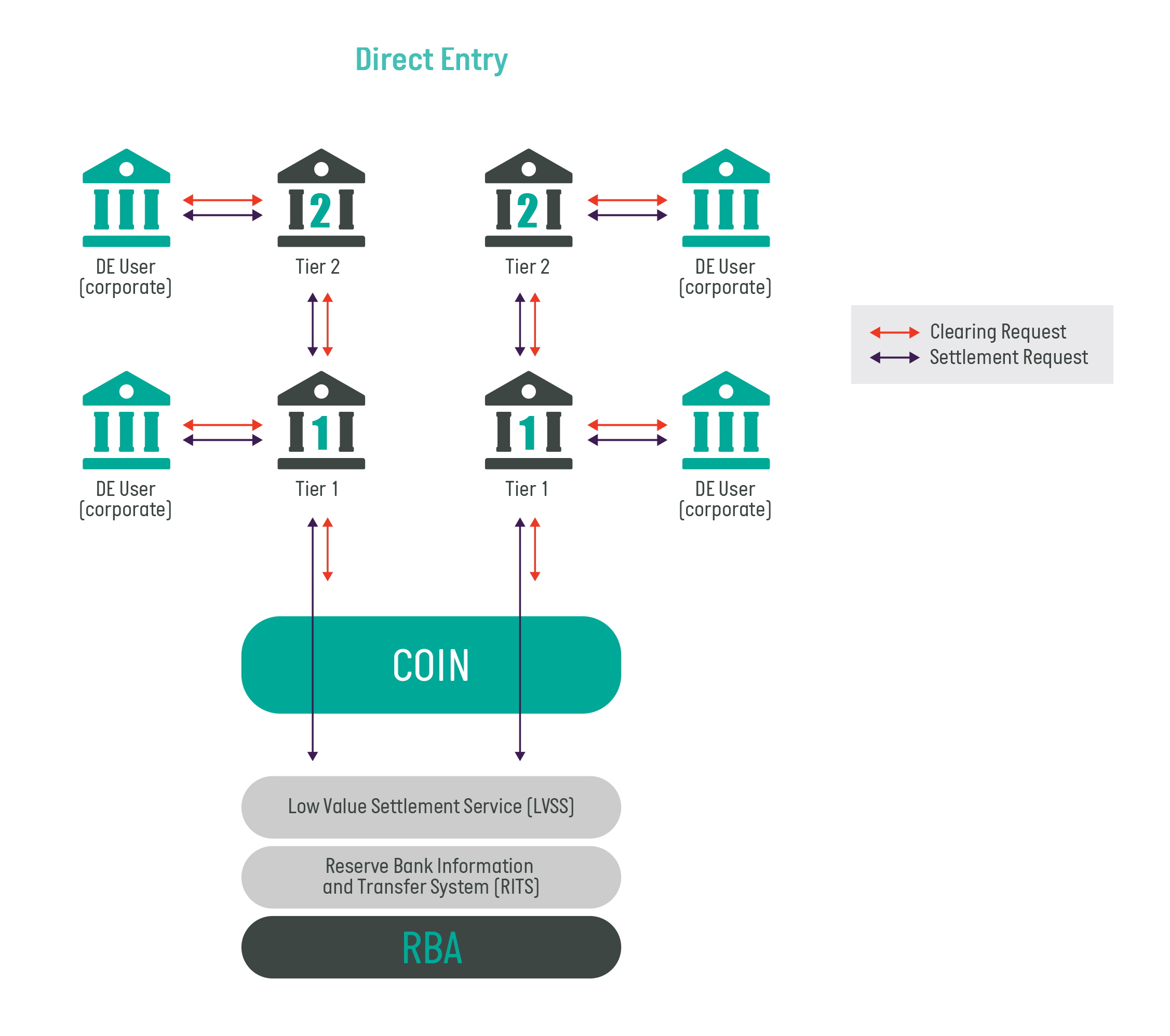

The DE system operates a two-tier model for organisations that need to send or receive bulk payment instructions.

Participants in the system are either Tier 1 or Tier 2 BECs members. Tier 2 members appoint a Tier 1 member as their representative in settling payment obligations. Depending on the type of payment services they offer, they may hold an ADI licence of an AFSL.

Tier 1 members must be able to clear and settle direct entry files through an ESA with other tier 1 members. They are therefore usually ADIs & AFSL holders.

Each BECS member has a unique BSB number (issued by AusPayNet), which is used to route transactions to the correct destination.

Tier 1 members’ settlement files are passed in batches to the RBA’s RITS system - via the COIN - five times every business day.

Direct Entry

Accessing the DE system

Organisations wanting to process direct credits or direct debits have three options:

- join BECS (as a Tier 1 or Tier 2 member) and obtain a BSB number,

- enter into a commercial agency arrangement with a BECS member and use one of their BSB numbers,

- enter a commercial arrangement with a BECS member to sponsor them as a DE User and obtain their own ID number.

Most non-ADIs choose to become DE Users; hundreds of thousands of service providers and merchants currently access BECS in this way. However, some non-ADIs join as BECS members.

DE Users usually get their bank, an existing BECS member, to sponsor them into the system. Each DE User is given a unique ID, known as a BUDS ID, which BECS participants use to reconcile DE payment traffic. Banks are responsible for their sponsored DE Users adhering to BECS rules.

BECS members’ requirements.

DE payments are cleared and settled between Tier 1 members, as a service both to their own customers and to the Tier 2 members they represent. Tier 1 members manage all the relationships (network, technology, regulatory) needed to access and participate in the DE system.

Tier 1 members need to meet these requirements:

- Comply with AusPayNet’s DE (BECS) governance framework

- Have established an ESA with the RBA

- Have access to the COIN

Tier 2 members need to establish a commercial arrangement with a Tier 1 member, which will provide services including:

- Clearing and settlement

- Access to the COIN

- Fraud mitigation services and transaction monitoring

Depending on their business model Tier 2 members may need an ADI Licence from APRA and/or an AFSL from ASIC.

Other considerations

The payments industry has invested in developing newer systems that offer faster and more flexible options for low-value payments. Many BECS payments are migrating to these systems; for example, a significant majority of “pay anyone” transactions now occur via the NPP. Banks and other financial services providers are also exploring ways to make it easier to process batch payment files and submit payments via APIs using systems other than BECS.