Cross-Border Payments Roundup - October 2025

Welcome

Welcome to the latest edition of Cross-Border Payments Round-Up, a biannual newsletter sharing updates on the progress on the G20 Roadmap for Enhancing Cross-border Payments.

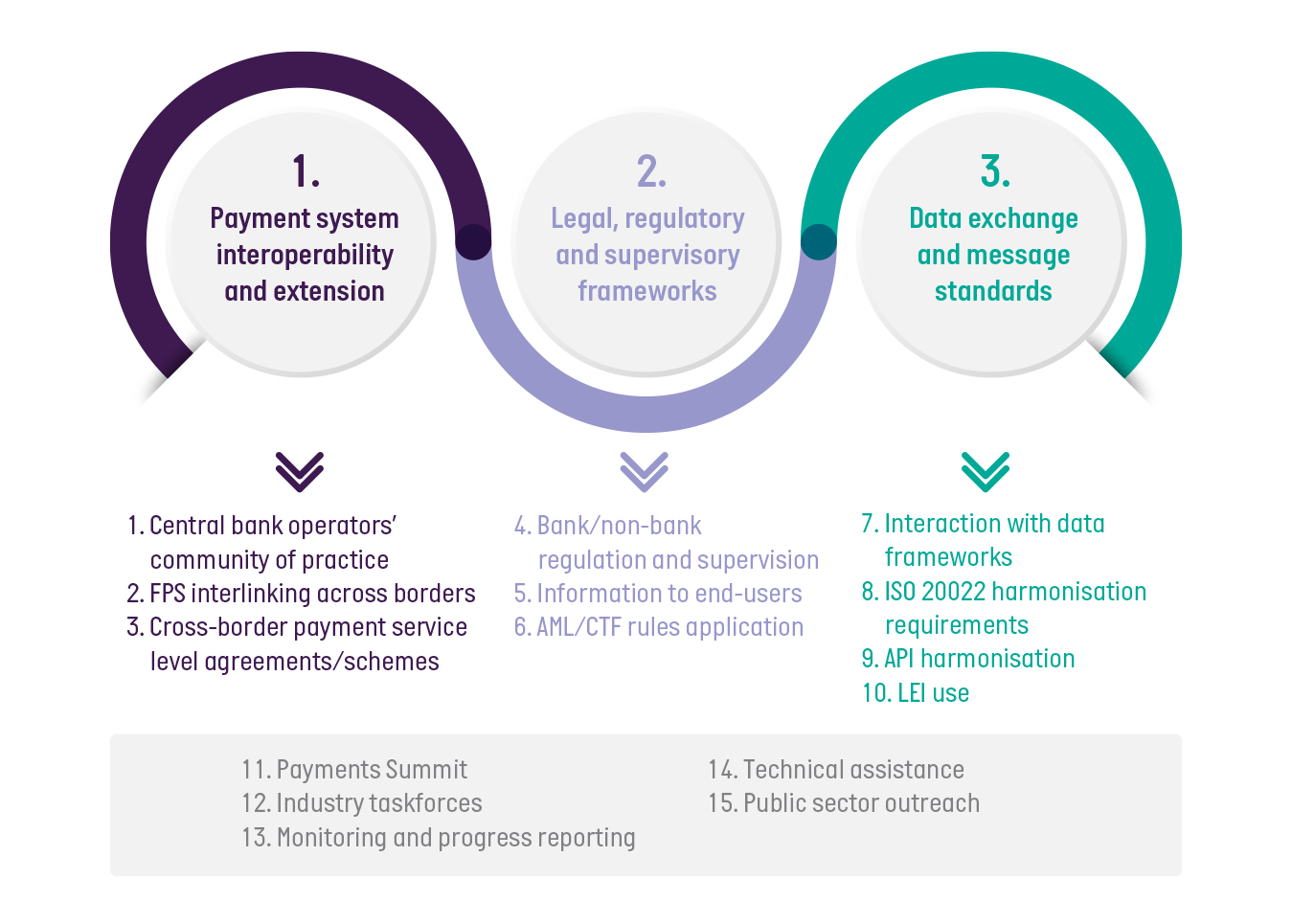

The Financial Stability Board (FSB) continues its work on action items across three priority themes, underpinned by five further generic actions.

Source: FSB

Cross-Border Payments Advisory Council (CBPAC)

AusPayNet’s CBPAC continues to support and coordinate industry activities that will be key to successfully implementing the G20 Roadmap and domestic cross-border payment priorities. The targets remain in place and are in Appendix 1.

General round-up

The FSB continues work on its Priorities for the next phase of work and G20 Roadmap for Enhancing Cross-Border Payments: Priority actions for achieving the G20 Target. The FSB remains fully committed to achieving the Roadmap targets under its new Chair, Andrew Bailey, Governor of the Bank of England, who was confirmed at the FSB Plenary in June. Andrew set out his priorities in a letter to the G20 Finance Ministers and Central Bank Governors in July.

The industry looks forward to this month's FSB report on progress towards the G20’s goal of making cross-border payments faster, cheaper, more transparent and accessible. The FSB will also focus on improving the end-user experience, working closely with the Bank for International Settlements Committee on Payments and Market Infrastructures (CPMI) and other partner organisations to achieve this shared goal.

To support the G20 Targets of speed and transparency, Swift has announced an initiative to create a new standard for cross-border retail payments. A coalition of 30 early-adopter banks, together with Swift, are committing to:

- upfront transparency on payment and FX fees

- guaranteed full-value delivery

- end-to-end visibility of transactions

- commitment to instant settlement where available.

These rules are designed to provide retail customers and small businesses with a payment service that reflects the G20’s aspirations for international payments. The coalition includes many leading global banks as well as several Australian banks.

At Sibos, Swift announced it is adding a blockchain-based shared ledger to their technology infrastructure. With an initial cohort of 30 global financial institutions, the first use case will be focussed on 24/7 real-time cross-border payments. The solution will be interoperable with the existing payment rail and will leverage ISO 20022.

Taskforce progress

The reconstitution of membership of the CPMI and FSB Taskforces is now complete, and Australia has expanded its participation in these taskforces, with AusPayNet now taking an active role in both alongside CBA and ANZ, who retain their membership.

Payment System Interoperability and Extension (PIE) Taskforce

CPMI’s PIE Taskforce held its first meeting with its new composition of members on 21 May. This meeting took a moment to pause and look to recalibrate future priorities. The Taskforce also acknowledged the considerable progress made by the existing task teams, which have been focusing on:

- expanding payment system access and operating hours.

- promoting fast payment systems (FPS) and their interlinking for cross-border payments.

- fostering ISO 20022 harmonisation.

- developing market intelligence and identifying supply-side opportunities.

These teams, and potentially additional task teams, will continue the work to foster and facilitate faster, cheaper, more accessible and more transparent cross-border payments.

Task Team 2 presented two draft papers to the PIE Taskforce members:

- Enhancing cross-border payments: FPS interlinking opportunities and recommendations: This paper drew several conclusions regarding interlinking domestic and regional FPS for cross-border payments. These included:

- enabling FPS domestic schemes to enable both sending and receiving cross-border payments

- enhancing access to include non-bank payment service providers (PSPs)

- the fostering of interoperability through common standards

- support reciprocity at a reasonable cost with consistent user experiences for end users on both sides of the transaction

- prioritise harmonisation of anti-money laundering (AML) and all sanction screening to increase speed and reduce cost through automation.

- Enhancing cross-border payments: Addressing fraud in cross border payments: The Task Team acknowledged that fraud detection and prevention in cross-border payments is a substantial challenge. It was concluded that mitigating solutions such as pre-validation; standardised Know Your Customer (KYC) practices; effective funds repatriations; sharing information on compliance checks; use of artificial intelligence (AI); and industry collaboration should be considered. It was also agreed that the public sector has a role to play by fostering collaboration, harmonising regulations and supporting innovative solutions that significantly enhance the security and efficiency of global payment systems.

These papers will be published at a later date.

In its second meeting on 8 September, CPMI and the PIE Taskforce members began to scope the future priorities and associated work streams, with FPS emerging as a focus.

Legal, Regulatory and Supervisory (LRS) Taskforce

A considerable friction in cross-border payments has been the explosive growth of fraud and scams. The FSB’s LRS Taskforce held a workshop in June to explore this issue. AusPayNet spoke on two panels. The first centred on Australia’s approach to tackling card-not-present fraud and private sector collaboration through the Australian Financial Crimes Exchange (AFCX). In the second panel, AusPayNet introduced the concept of Safety-by-Design (SbD) and discussed its utility to PSPs and payment system operators. SbD was developed by Australia’s eSafety Commissioner.

SbD offers a paradigm shift. Just as Privacy-by-Design and Security-by-Design transformed data protection and cybersecurity, SbD embeds user safety considerations into payment system architecture, from conception to deployment. AusPayNet distributed its whitepaper on SbD to LRS Taskforce members and released it publicly in August.

Workshop panellists and participants concluded that payment fraud requires a comprehensive and collaborative response across the eco-system, particularly with respect to cross-border payments. Moreover, technology is not only a tool for prevention but also an enabling tool for fraudsters. A common taxonomy of frauds and scams is desirable to ensure common understanding within the ecosystem.

The FSB began working with the Organisation for Economic Development (OECD) Working Party on Financial Consumer Protection, Education and Inclusion to develop guidance for the implementation of the Working Party’s high-level principles related to transparency of retail cross-border payments and remittances. To further understand jurisdictional approaches to transparency, the FSB is leveraging LRS Taskforce private sector membership to provide practical examples and industry practices on how they offer transparency to users of cross-border payment services. This call for information focuses on current examples and business practices, as well as potential avenues for improvement and any legal, regulatory or supervisory issues. The information will help to inform the progress made on transparency under the Roadmap.

Data exchange and message standards

Advisory group to the Forum on Cross-Border Payments Data

The FSB held its inaugural Forum on Cross-Border Payments Data in May. The Forum and the Advisory Group were established in 2025 and aim to address challenges related to the collection, storage and management of payment-related data across borders. Differences in laws, regulations and practices between countries can create unnecessary frictions in cross-border payments, increasing costs and risks for businesses and individuals. By bringing together regulatory authorities, data protection experts and private-sector representatives, the Forum works to align data frameworks while ensuring compliance with AML, combatting the financing of terrorism (CFT), and upholding data privacy standards.

The Forum and Advisory Group work with international organisations, including with the Financial Action Task Force (FATF) and OECD, and serve as a platform for dialogue, collaboration and research, helping to identify and address inconsistencies in global data frameworks.

Forum members discussed issues emerging from data frameworks that create unnecessary frictions in cross-border payments and how the Forum could work to address these issues. The Forum agreed that identifying and mapping divergences in data frameworks is a key priority. Sharing of information, supporting innovation and engagement with the private sector are also critical to reducing unnecessary frictions.

Financial Action Task Force

In June, after two public consultations, the FATF released its revised Recommendation 16, Payment Transparency, as well as the accompanying Interpretive Note. Recommendation 16 has the objective of preventing terrorists, perpetrators of money laundering and associated predicate offences from having unfettered access to payments or value transfers for moving their funds. The scope of changes is significant and these will come into effect by the end of 2030. AUSTRAC will be one of the responsible Australian regulators and, in the coming years, will incorporate the changes into its AML/CTF Rules.

In other news

On 29 August, AUSTRAC tabled the new Anti-Money Laundering and Counter-Terrorism Financing Rules 2025 (the Rules) and an Explanatory Statement in Parliament, following a two-stage public consultation process. The new Rules come into effect at different stages. From 31 March 2026, changes to AML/CTF obligations commence for current reporting entities, except for threshold transaction reporting and suspicious matter reporting, which will remain the same until 2029.

To meet obligations under the amended Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (the Act), businesses are required to:

- familiarise themselves with the Rules and related laws

- consider how the changes impact their business.

AUSTRAC has also released its 2025-26 Regulatory Priorities, in which it says it will focus the majority of its regulatory effort over the next 12 months on seven outcome areas:

- Tranche 2 entities understand their AML/CTF obligations and start appropriately managing their ML/TF/PF risks.

- Existing reporting entities implement changes to their AML/CTF programs and practice, to align with changes in the legislative regime.

- An increased proportion of entities understand and comply with their suspicious matter reporting obligations.

- Improved ML/TF/PF risk management within the digital currency exchange and virtual asset service provider sectors.

- Improved risk management by reporting entities whose exposure to cash creates ML/TF/PF vulnerabilities.

- An increased proportion of existing reporting entities update their enrolment details when required under the AML/CTF Act and Rules.

- Increased capability and coordination around the management of ML/TF/PF risks in the Pacific region.

Project Acacia, a joint initiative between the RBA and the Digital Finance Cooperative Research Centre (DFCRC), announced that a number of industry participants have been selected to explore how innovations in digital money and existing settlement infrastructure might support the development of Australian wholesale tokenised asset markets. Proposed settlement assets for the use cases include stablecoins, bank deposit tokens and pilot wholesale central bank digital currency (CBDC), as well as new ways of using banks’ existing exchange settlement accounts at the RBA.

In September, Swift announced it has partnered with 13 global banks to demonstrate how artificial intelligence (AI) and privacy-enhancing technologies (PETs) could help the industry tackle fraud in cross-border payments. Swift revealed that in trials involving 10 million artificial transactions, the collaborative model was twice as effective in real-time fraud detection compared to models trained on data from a single institution. With global fraud accounting for an estimated US$485 billion in 2023, according to Nasdaq Verafin, the imperative for the industry must be greater collaboration between institutions with a borderless view. Enhancing safety in payments through these initiatives restores consumer confidence in cross-border payments and reduces frictions, which helps deliver on the G20 Roadmap.

Please reach out if you would like further information or if there are any specific topics that you would like us to cover in future newsletters.

Contact:

David O’Mahony

Business Analyst, AusPayNet

Email: domahony@auspaynet.com.au

Appendix 1

| Wholesale | Retail (e.g. B2B, P2B/B2P, Other P2P3) | Remittances | |

| Cost | No Target Set | Global average cost of payment to be no more than 1%, with no corridors with costs higher than 3% by end-2027 | Reaffirm UN SDG: Global average cost of sending $200 remittance to be no more than 3% by 2030, with no corridors with costs higher than 5% |

| Speed | 75% of cross-border wholesale payments to be credited within one hour of payment initiation or within one hour of the pre-agreed settlement date and time for forward dated transactions and for the remainder of the market to be within one business day of payment initiation, by end-2027. Payments to be reconciled by end of the day on which they are credited, by end-2027. | 75% of cross-border retail payments to provide availability of funds for the recipient within one hour from the time the payment is initiated and for the remainder of the market to be within one business day of payment initiation, by end-2027. | 75% of cross-border remittance payments in every corridor to provide availability of funds for the recipient within one hour of payment initiation and for the remainder of the market to be within one business day, by end-2027 |

| Access | All financial institutions (including financial sector remittance service providers) operating in all payment corridors to have at least one option and where appropriate, multiple options(i.e. multiple infrastructures or providers available) for sending and receiving cross-border wholesale payments by end-2027 | All end-users (individuals, businesses (including MSMEs) or banks to have at least one options (i.e. at least one infrastructure or provider available) for sending or receiving cross-border electronic payments by end 2027 | More than 90% of individuals (including those without bank accounts) who wish to send or receive a remittance payment to have access to a means of cross-border electronic remittance payment by end-2027 |

| Transparency | All payment service providers to provide at a minimum the following list of information concerning cross-border payments to payers and payees by end-2027: total transaction cost (showing all relevant charges including sending and receiving fees including those of any intermediaries, FX rate and currency conversion charges); the expected time to deliver funds; tracking of payment status; and terms of service. | ||

Source: FSB

Note:

Wholesale Payment: Has a value threshold of US$100,000 or greater

Retail Payment: Has a value threshold of less than US$100,000 but greater than US$200

Remittance Payment: Has a value threshold of US$200 or below