Cross-Border Payments Round-Up - September 2024

Welcome

Welcome to the second edition of AusPayNet’s Cross-Border Payments Round-Up for 2024; our biannual newsletter sharing updates on the progress of the G20 Roadmap for Enhancing Cross-border Payments.

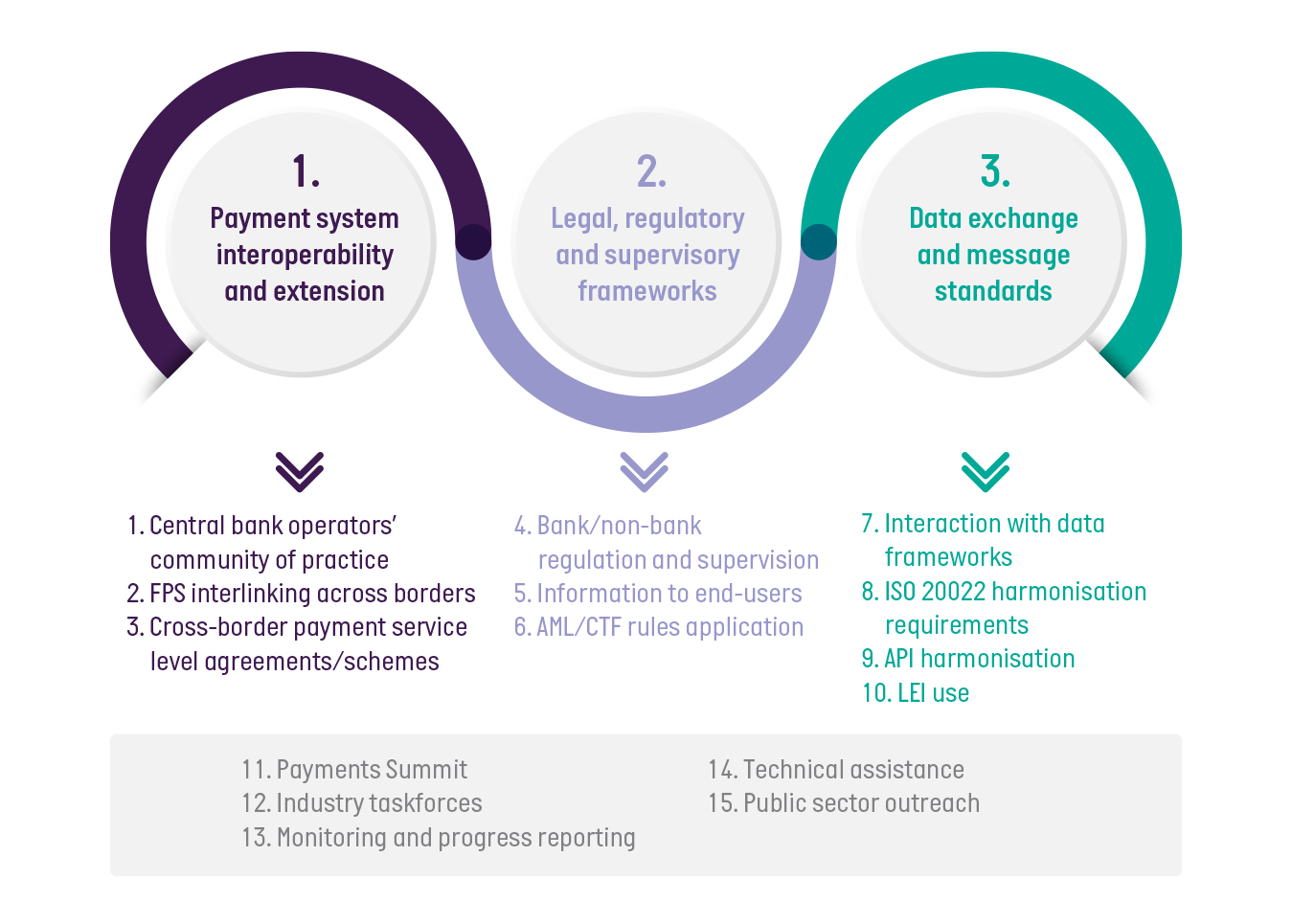

The Financial Stability Board (FSB) continues its work on the 10 action items across the three priority themes, underpinned by five further generic actions.

Source: FSB

Cross-Border Payments Advisory Council (CBPAC)

AusPayNet’s CBPAC continues to support and coordinate industry activities that will be key to successfully implementing the roadmap and Australian cross-border payment priorities. The targets remain in place and are outlined in Appendix 1.

General Round-Up

In the Chair’s Communiqué from their July 2024 meeting, the G20 Finance Ministers and Central Bank Governors reiterated their commitment to timely and effective implementation of the G20 Roadmap to Enhance Cross-border Payments and stated that they look forward to the FSB's progress report on the Roadmap while also progressing toward the quantitative targets.

The FSB continues with its Work Programme for 2024. As expected, the Work Programme includes an annual progress report on the overall roadmap.

Priority Theme Taskforce Progress

Payment System Interoperability and Extension (PIE) Taskforce

The most recent meeting of the PIE Taskforce was held in July, and artefacts have been published. The Taskforce established four task teams that, over the course of 2024, have focused on:

Task Team 1

- the benefits and challenges faced by private payment system operators and non-bank payment service providers (PSPs) towards expanding payment system access

- the challenges and benefits for all types of payment system participants towards extending operating hours of privately operated real-time gross settlement (RTGS) systems, and the possible alternatives, with a focus on the most affected corridors

- the mitigation of foreign exchange (FX) settlement risk and the exploration of solutions for cross-border payments using currencies for which payment-versus-payment (PvP) arrangements are not available.

Task Team 2

- the design and operational elements of fast payment systems (FPS) that support cross-border interlinking

- the promotion of fast payment schemes that support cross-border payments

- the industry practices and lessons learned to prevent fraud and foster straight through processing.

Task Team 3

- the adoption of the Committee on Payments and Market Infrastructures (CPMI) harmonised ISO 20022 data requirements

- efforts to standardise the use of ISO 20022 messaging to promote efficient payment processing and enhance the cross-border interoperability of payment systems.

Task Team 4

- takes stock of and monitors ongoing industry initiatives to achieve the G20 targets, including possible future dissemination efforts

- plans to highlight the advantages and opportunities offered by the G20 Roadmap to the supply side.

Legal, Regulatory and Supervisory (LRS) Taskforce

The FSB has published artefacts from the LRS Taskforce meeting held on 22 April.

At this meeting, the following occurred:

- LRS members finalised the bank and non-bank supervision (BNBS) consultative report

- The Chair of the FSB working group on cross-border payments data and identifiers (CPDI) introduced the draft recommendations to address unnecessary frictions from data frameworks that pose significant challenges to improving the cost, speed, transparency and access of cross-border payments.

Following the LRS Taskforce meeting, two consultations were released in July, to which AusPayNet will coordinate an industry response:

- Recommendations for Regulating and Supervising Bank and Non-bank Payment Service Providers Offering Cross-border Payment Services: Consultation report

- Recommendations to Promote Alignment and Interoperability Across Data Frameworks Related to Cross-border Payments: Consultation report.

Data Exchange and Message Standards

With respect to ISO 20022 harmonisation efforts, the High Value Payments Systems (HVPS+) have included a cross-group alignment section in their Change Management Process. This will strive to bring cross-group alignment for changes between HVPS+ and others such as Cross-Border Payments and Reporting (CBPR+), Payments Market Working Group (PMPG) and Common Global Implementation Market Practice (CGI_MP). This is in keeping with CPMI’s Harmonised ISO 20022 data requirements for enhancing cross-border payments – final report.

API Panel of Experts

The panel is currently evaluating APIs to develop recommendations for greater harmonisation of APIs in cross-border payments. It will produce some artefacts in Q4 2024.

Other news

Transparency and cost of payments

In July, the Australian Competition and Consumer Commission (ACCC) published its ‘Transparency and competition in international money transfer services’ survey results. In this report, the ACCC notes improvement in transparency in payments and a decline in the costs of cross-border payments. The report observes that the cost of International Money Transfers (IMT) from Australia has decreased but remains above G20 targets. Further, it says:

“The RBA has been monitoring Australia’s progress against the G20 targets, and they have indicated that there remains substantial scope to improve the average cost of cross-border payments for customers in Australia.”

Based on their survey results, the ACCC has further released a draft update to its Best Practice Guidance, which now includes recommendations that IMT suppliers:

- deduct fees from the amount inserted. This includes both in the FX calculator and in the backend of transactions, to ensure consumers are not misled as to how transactions are processed or the amounts that will be received

- prominently display the estimated time a transfer will take to reach its destination. This should be as accurate as possible and relevant to every corridor the supplier offers

- provide customers the ability to track the status of their payment.

The ACCC advises that the Best Practice Guidance remains voluntary. However, they strongly encourage all IMT suppliers to implement the recommendations. The ACCC will continue its advocacy on this issue and will follow up with industry and government if there is non-adherence. If non-adherence is persistent, Government may consider a mandatory code.

CPMI survey results

In June, CPMI published Steady as we go: results of the 2023 CPMI cross-border payments monitoring survey, highlighting the complexity required to deliver on the G20’s Roadmap for Enhancing Cross-Border Payments. It also notes the successes, such as expanded interest in FPS interlinking and migration to ISO 20022, as well as RTGS payment systems operators undertaking to review their operating hours.

Progress of G20 goals in Australia

Australia, too, is making inroads into achieving the G20s goal of faster, cheaper, transparent and accessible cross-border payments. August and September were busy months for ANZ, CBA and NAB who have all announced that they now utilise the New Payments Platforms’ (NPP) International Payments Service (IPS) for the settlement of the final domestic leg of an inbound international payments (to another Australian bank that is also on NPP), allowing consumers and businesses to receive funds to their account faster.

This aligns fully with the G20 roadmap for improving cross-border payments, with customers being paid their funds from overseas in a matter of minutes, 24 hours a day, seven days a week.

Similarly, Project Nexus, a platform designed to standardise how domestic Fast Payment Systems (FPS) connect to each another, has completed Phase Three and is now embarking on Phase Four, which will allow participants to work towards seamlessly connecting their instant payment systems. In Phase Four, Bank Negara Malaysia, Bangko Sentral ng Pilipinas, the Monetary Authority of Singapore, the Bank of Thailand and their domestic FPS operators will be joined by the Reserve Bank of India. This expands the user base to India's Unified Payments Interface (UPI), the world's largest FPS. Other ASEAN members who are party to the Regional Payment Connectivity MoU (Brunei, Laos and Vietnam) will likely join Phase Four at a later stage.

In July, the Pacific Banking Forum in Brisbane saw significant commitments from participating correspondent banks to provide technical feedback on the proposed World Bank project and to engage Pacific Island governments and respondent banks to consider strengthening cross border remittances through the region, in line with countries’ enhancements of their AML/CFT frameworks and regional uplift of safe and sustainable banking sectors. This will involve a significant level of technical assistance being provided by both the World Bank and the International Monetary Fund that seeks to enable continuous access to correspondent banking services in the participating Pacific Island countries.

Stablecoins

Stablecoins continue to garner interest and traction in the mainstream financial sector. The FSB has published a paper, Cross-border Regulatory Issues of Global Stablecoin Arrangements in EMDE. This paper highlights the potential fragility of stablecoins that are not adequately designed and regulated, particularly in terms of additional risks and challenges to which some emerging market and developing economies (EMDE) may be exposed. This issue was emphasised by the FSB Chair’s letter to the G20 Finance Ministers and Central Bank Governors meeting in July.

Global Legal Entity Identifier Foundation

We also acknowledge the 10th anniversary of the Global Legal Entity Identifier Foundation (GLEIF). The FSB established GLEIF in June 2014, in the wake of the global financial crisis (GFC) of 2007-2009, with a mission to provide transparency in global financial transactions and to reinstate trust, one of the key lessons learned from the GFC. Today, GLEIF maintains the Legal Entity Identifier (LEI), a 20-character alpha-numeric code that serves as an international ID for businesses. Implementation of the LEI has increased regulators’ ability to evaluate systemic and emerging risk, identify trends and take corrective steps. It continues to evolve with a position that broad adoption will generate advantages for the wider business community.

We look forward to continuing to work with you through 2024.

Contact:

David O’Mahony

Email: domahony@auspaynet.com.au

Please reach out if you would like further information or if there are any particular topics that you would like us to cover in future newsletters.

Appendix 1

| Wholesale | Retail (e.g. B2B, P2B/B2P, Other P2P3) | Remittances | |

| Cost | No Target Set | Global average cost of payment to be no more than 1%, with no corridors with costs higher than 3% by end-2027 | Reaffirm UN SDG: Global average cost of sending $200 remittance to be no more than 3% by 2030, with no corridors with costs higher than 5% |

| Speed | 75% of cross-border wholesale payments to be credited within one hour of payment initiation or within one hour of the pre-agreed settlement date and time for forward dated transactions and for the remainder of the market to be within one business day of payment initiation, by end-2027. Payments to be reconciled by end of the day on which they are credited, by end-2027. | 75% of cross-border retail payments to provide availability of funds for the recipient within one hour from the time the payment is initiated and for the remainder of the market to be within one business day of payment initiation, by end-2027. | 75% of cross-border remittance payments in every corridor to provide availability of funds for the recipient within one hour of payment initiation and for the remainder of the market to be within one business day, by end-2027 |

| Access | All financial institutions (including financial sector remittance service providers) operating in all payment corridors to have at least one option and where appropriate, multiple options(i.e. multiple infrastructures or providers available) for sending and receiving cross-border wholesale payments by end-2027 | All end-users (individuals, businesses (including MSMEs) or banks to have at least one options (i.e. at least one infrastructure or provider available) for sending or receiving cross-border electronic payments by end 2027 | More than 90% of individuals (including those without bank accounts) who wish to send or receive a remittance payment to have access to a means of cross-border electronic remittance payment by end-2027 |

| Transparency | All payment service providers to provide at a minimum the following list of information concerning cross-border payments to payers and payees by end-2027: total transaction cost (showing all relevant charges including sending and receiving fees including those of any intermediaries, FX rate and currency conversion charges); the expected time to deliver funds; tracking of payment status; and terms of service. | ||

Source: FSB

Note:

Wholesale Payment: Has a value threshold of US$100,000 or greater

Retail Payment: Has a value threshold of less than US$100,000 but greater than US$200

Remittance Payment: Has a value threshold of US$200 or below