Cross-Border Payments Round-Up - March 2024

Welcome

Welcome to the fifth Cross-Border Payments Round-Up, a biannual newsletter sharing updates on the progress of the G20 Roadmap for Enhancing Cross-border Payments.

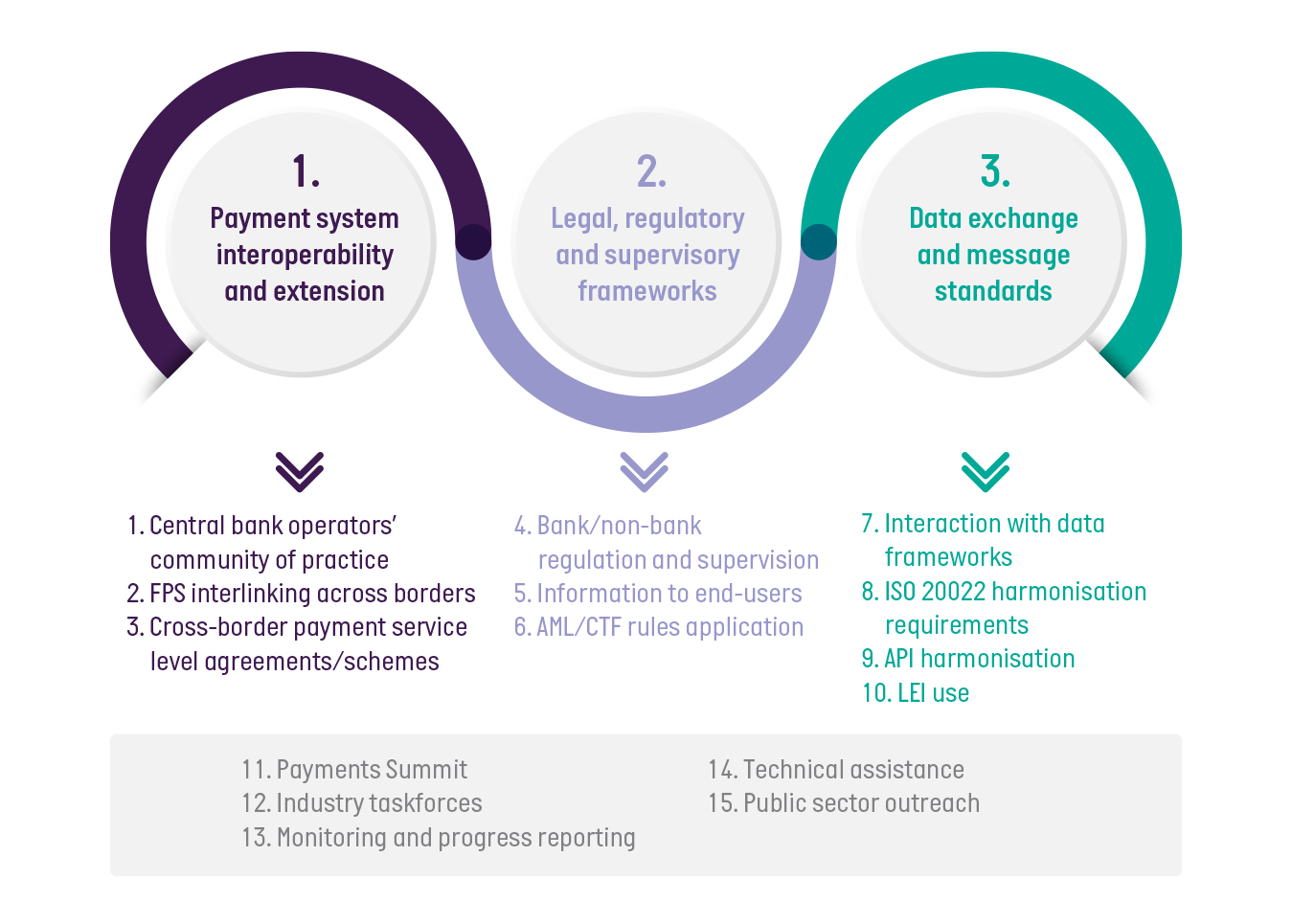

The Financial Stability Board (FSB) continues its work on the 10 action items across the three priority themes, underpinned by five further generic actions.

Source: FSB

Cross-Border Payments Advisory Council (CBPAC)

AusPayNet’s CBPAC continues to support and coordinate industry activities that will be key to successfully implementing the roadmap and domestic cross-border payment priorities.

General Round-Up

The Chair of the Financial Stability Board (FSB), in his letter of 20 February 2024 to the G20 Finance Ministers and Central Bank Governors, articulated the Board’s continuing work on cross-border payments. This includes strengthening the collaboration between the public and private sectors, including with experts in anti-money laundering and counter-terrorism financing (AML/CTF) and data protection. The Chair remains of the view that with continuing support and sustained efforts by both the private and public sector, the G20’s targets for making cross-border payments faster, cheaper, and more transparent and inclusive (Appendix 1) will be achieved by 2027.

The G20 Finance Ministers and Central Bank Governors held their first meeting in Sao Paulo, Brazil last month. The Chair’s summary reiterated their support of the work of the FSB and other standard-setting bodies. They also agreed on the importance of understanding the benefits and vulnerabilities coming from digital innovations, including tokenisation and artificial intelligence (AI), and of implementing the G20 Roadmap for Enhancing Cross-border Payments. An annex attached to the summary outlines the key priorities proposed by the Brazilian G20 Presidency for each G20 workstream, building on legacy work and previous accomplishments. The Digital Innovations and Cross-border Payments sections of the annex are particularly relevant.

The FSB has also published its Work Programme for 2024 which, as expected, will provide an annual progress report on the overall roadmap. The Board will also:

- prepare a second report on progress towards the targets

- issue further recommendations to promote and align data frameworks related to cross-border payments

- develop recommendations to strengthen the consistency of regulation and supervision of banks and non-banks providing cross-border payments services

- issue a report on progress in the use of Legal Entity Identifiers (LEIs) in cross-border payments.

Priority Theme Taskforce Progress

Payment System Interoperability and Extension (PIE) Taskforce

The most recent meeting of the PIE Taskforce was held in November 2023. The taskforce has established four task teams that, over the course of 2024, will focus on:

-

Expanding payment system access and operating hours

-

Promoting fast payment systems and their interlinking for cross-border payments

-

Fostering ISO 20022 harmonisation

-

Developing market intelligence and identifying supply side opportunities (i.e. expanding the reach of ISO 20022 to a broader range of vendors that support corporates).

Legal, Regulatory and Supervisory (LRS) Frameworks

In the spirit of public and private sector collaboration, the Financial Action Task Force (FATF) released its Public Consultation on Recommendation 16 (Wire Transfers) on Payment Transparency. This extensive consultation covers both the Recommendation and the associated Interpretive Note. The consultation covers a number of technical elements, including:

- Additional transparency requirements on exemption for purchase of goods and services using cards

- Removal of the withdrawal or purchase of cash or a cash equivalent from the Recommendation 16 exemption, subject to certain conditions

- Improving the content and quality of basic originator and beneficiary information in payment messages

- Obligations on beneficiary financial institutions to check alignment of beneficiary information in payment messages

- Definition of payment chain and conditions for net settlement.

AusPayNet, together with CBPAC is working with our Members to coordinate a response to the consultation, with responses due by 3 May 2024. The FATF has also flagged additional engagement with stakeholders as part of its wider consultation process on updating Recommendation 16.

LRS Taskforce

The LRS Taskforce last met in September 2023. The LRS Taskforce has a longer cadence between meetings, no doubt a reflection on the complexity of the matters it is required to consider.

Cross-Border Data Exchange and Message Standards

The Commonwealth Bank of Australia recently joined the Global Legal Entity Identifier Foundation’s (GLEIF's) Validation Agent program to proactively drive client adoption.

In a separate Australian development shaping LEI adoption, new over-the counter (OTC) derivative transaction reporting rules from the Australian Securities and Investments Commission (ASIC) come into force in October and mandate the LEI as the only permitted entity identifier for counterparty identification.

API Panel of Experts

The panel is currently evaluating APIs to develop recommendations for greater harmonisation of APIs in cross-border payments. It will produce some artefacts towards the middle of the year.

We look forward to working with you through 2024.

Contact:

David O’Mahony

Email: domahony@auspaynet.com.au

Please reach out if you would like further information or if there are any particular topics that you would like us to cover in future newsletters.

Appendix 1

| Wholesale | Retail (e.g. B2B, P2B/B2P, Other P2P3) | Remittances | |

| Cost | No Target Set | Global average cost of payment to be no more than 1%, with no corridors with costs higher than 3% by end-2027 | Reaffirm UN SDG: Global average cost of sending $200 remittance to be no more than 3% by 2030, with no corridors with costs higher than 5% |

| Speed | 75% of cross-border wholesale payments to be credited within one hour of payment initiation or within one hour of the pre-agreed settlement date and time for forward dated transactions and for the remainder of the market to be within one business day of payment initiation, by end-2027. Payments to be reconciled by end of the day on which they are credited, by end-2027. | 75% of cross-border retail payments to provide availability of funds for the recipient within one hour from the time the payment is initiated and for the remainder of the market to be within one business day of payment initiation, by end-2027. | 75% of cross-border remittance payments in every corridor to provide availability of funds for the recipient within one hour of payment initiation and for the remainder of the market to be within one business day, by end-2027 |

| Access | All financial institutions (including financial sector remittance service providers) operating in all payment corridors to have at least one option and where appropriate, multiple options(i.e. multiple infrastructures or providers available) for sending and receiving cross-border wholesale payments by end-2027 | All end-users (individuals, businesses (including MSMEs) or banks to have at least one options (i.e. at least one infrastructure or provider available) for sending or receiving cross-border electronic payments by end 2027 | More than 90% of individuals (including those without bank accounts) who wish to send or receive a remittance payment to have access to a means of cross-border electronic remittance payment by end-2027 |

| Transparency | All payment service providers to provide at a minimum the following list of information concerning cross-border payments to payers and payees by end-2027: total transaction cost (showing all relevant charges including sending and receiving fees including those of any intermediaries, FX rate and currency conversion charges); the expected time to deliver funds; tracking of payment status; and terms of service. | ||

Source: FSB

Note:

Wholesale Payment: Has a value threshold of US$100,000 or greater

Retail Payment: Has a value threshold of less than US$100,000 but greater than US$200

Remittance Payment: Has a value threshold of US$200 or below