Cross-Border Payments Roundup - April 2022

Welcome

Welcome to the first Cross-Border Payments Round-Up, a biannual newsletter sharing updates on the progress of the global roadmap for enhancing cross-border payments.

The Financial Stability Board's (FSB) 'Enhancing Cross-Border Payments Roadmap' aims to deliver faster, cheaper, more transparent and more inclusive cross-border payment services for all. Maintaining the safety and security of payments systems and platforms is paramount. Achieving these outcomes will have widespread benefits for citizens and economies worldwide. It will support economic growth, international trade, global development and financial inclusion.

This newsletter will provide updates on Australia’s progress in implementing the G20-agreed FSB Roadmap for Enhancing Cross-Border Payments.

In this inaugural issue, we will provide an overview of the FSB’s cross-border journey; updates on our industry activities that are supporting Australia’s response; an update on the FSB’s roadmap activities and the G20 public support for enhancing cross-border payments.

We also take a look at upcoming roadmap activities.

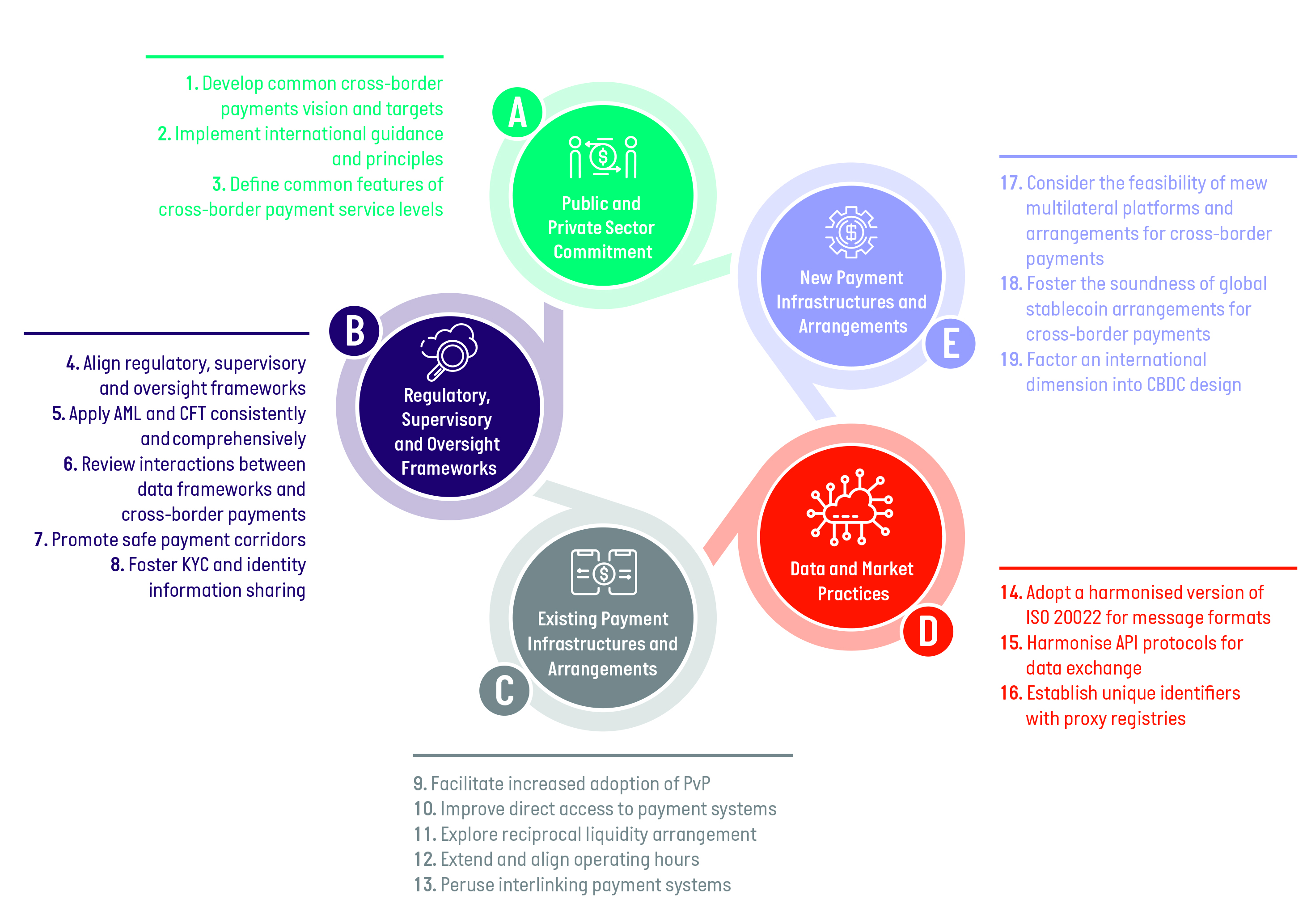

Three steps to building the FSB’s Roadmap to Enhance Cross-Border Payments

- Assessing the challenges and frictions in cross-border payments.

- Building a global roadmap— actions, timelines and targets for wholesale, retail and remittance.

Source: CPMI

Source: CPMI - Identifying the focus areas and building blocks to improving the current cross-border payment arrangements.

Source: FSB

Source: FSB

Cross-Border Payments Advisory Council

AusPayNet has formed the Cross-Border Payments Advisory Council (CBPAC) to oversee and coordinate Australian industry level activities to support delivery of the FSB Roadmap for Enhancing Cross-Border Payments. The Council will also support any actions taken to implement recommendations from domestic bodies, such as the Treasury’s Review of the Australian Payments System.

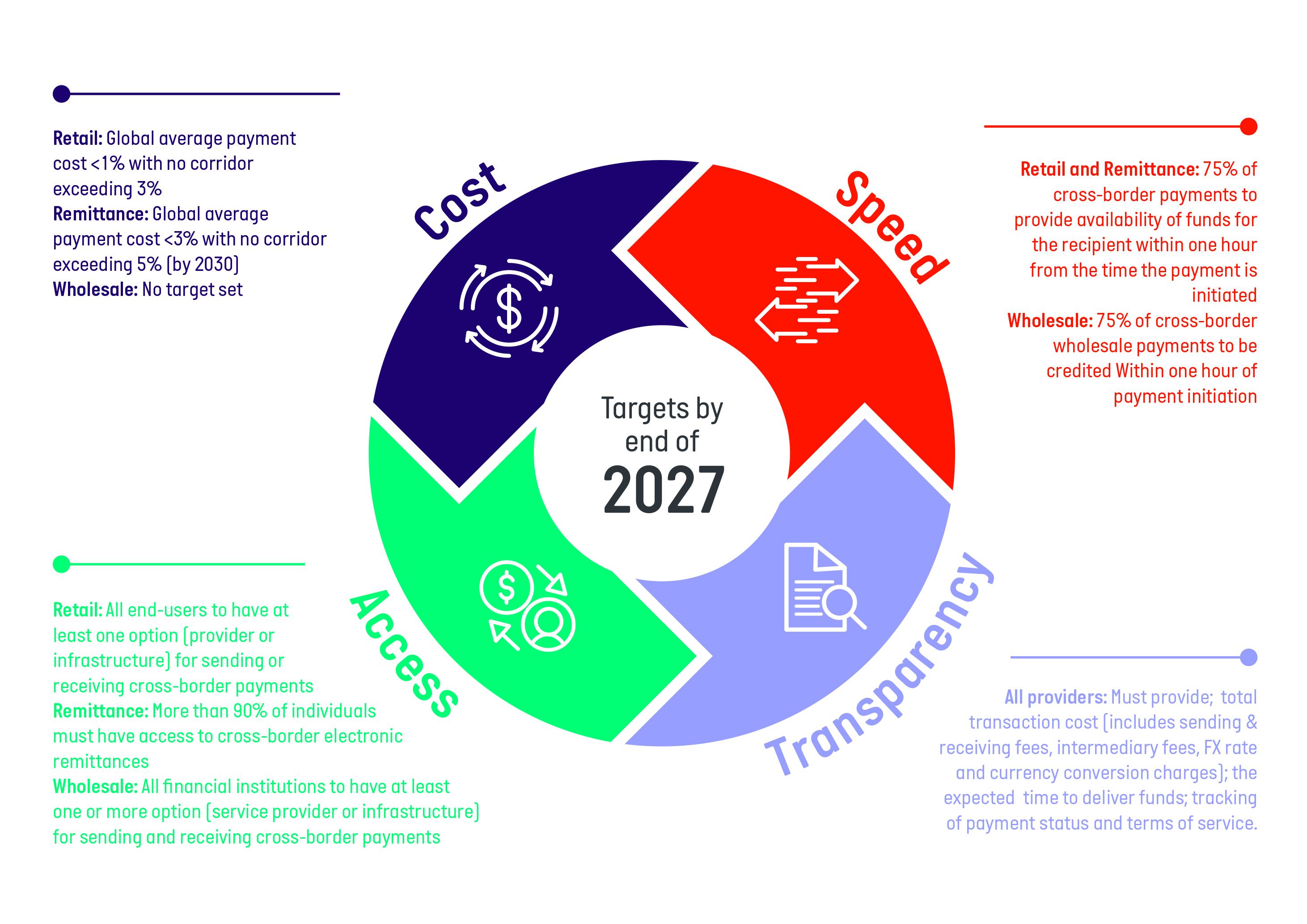

The FSB developed the roadmap in coordination with the Committee on Payments and Market Infrastructure (CPMI) and other relevant international organisations. It provides a high-level plan for addressing the key challenges of cross-border payments: cost, speed, access and transparency.

The CBPAC will support and coordinate industry activities, including involvement in consultations and delivering change, which will be key to successfully implementing the roadmap and domestic cross-border payment priorities.

Focus area progress

Focus Area A: Public and Private Sector Commitment

In July 2021, AusPayNet responded to a consultation on ‘Targets for addressing the four challenges of cross-border payments’ and submitted Australia's response.

Focus Area B: Regulatory, Supervisory and Oversight Frameworks

AusPayNet facilitated feedback on Building Block 6, ‘Reviewing the interaction between data frameworks and cross-border payments’. CBPAC was engaged to provide this feedback, which was submitted in August 2021.

Focus Area C: Existing Payment Infrastructures and Arrangements

In October 2021, AusPayNet coordinated a response to the CPMI consultation on ‘Facilitating increased adoption of PvP’. AusPayNet submitted its formal response to this consultation to the CPMI in November 2021.

In December 2021, CPMI issued a consultative document entitled ‘Extending and aligning payment system operating hours for cross-border payments’. AusPayNet consulted widely and submitted its formal response in mid-January 2022.

Focus Area D: Data and Market Practices

CPMI requested preliminary feedback on Building Block 15 ‘Harmonising API protocols for data exchange’ in relation to payment systems. AusPayNet does not currently, or plan to, use APIs for the frameworks it administers.

AusPayNet identified and engaged a payments systems provider which uses APIs to participate in the survey.

Focus Area E: New Payments Infrastructures and Arrangements

In November 2021, AusPayNet received a consultation report from CPMI and International Organization of Security Commissions (IOSCO) on the ‘Application of the principles for financial market infrastructures to stablecoin arrangements’.

AusPayNet identified recent work undertaken by another body with respect to the regulation of stablecoins. With their approval and with CBPAC input, AusPayNet leveraged the output to provide a response to the consultation, due to the global interest in this emerging payment type.

The FSB’s roadmap progress

In October 2021, the FSB issued its first consolidated progress report. The report highlighted initial steps that have been taken in preparation for the future roadmap activities and outlined the specific quantitative targets at the global level that address the challenges of cost, speed, transparency and access faced by cross-border payments. Targets will be made fully operational in 2022.

The FSB progress report concluded that most of the roadmap milestones set for 2021 had been successfully completed or are close to finalisation, with the roadmap’s end-goals firmly on track.

The G20’s commitment

In October 2021, the G20 Summit meeting was held in Rome. The leaders reiterated their commitment to a timely and effective implementation of the Roadmap for Enhancing Cross-Border Payments. They endorsed the ‘ambitious but achievable’ quantitative global targets for addressing the four challenges to cross-border payments by 2027, as set out in the FSB’s Final Report. The benchmarks for the four challenges are set out in full in Appendix 1 below.

The G20 Leaders Declaration (Appendix 2, Section 41) also welcomed and encouraged the continued analysis of the potential role of central bank digital currencies (CBDC) in enhancing cross-border payments and the wider implications of their use for the international monetary system.

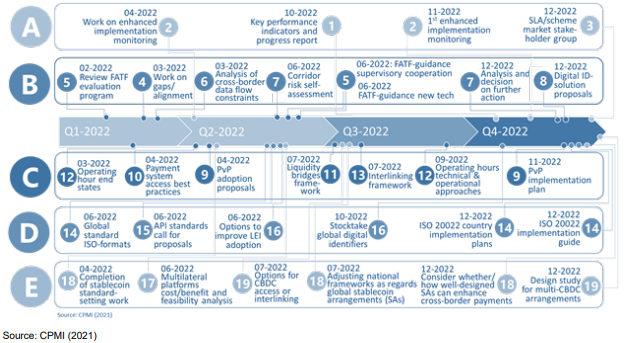

The roadmap will run over five years, with various stages of activity and implementation. The focus for 2022 is to complete further analysis but also to develop specific proposals for material improvement of underlying systems and arrangements.

What's Planned for 2022

Financial Stability Board

In 2022, the FSB will consult on the best approach in collating KPIs around the four challenges of cost, speed, access and transparency.

FSB will, in partnership with the Financial Action Task Force (FATF), International Monetary Fund (IMF) and World Bank (WB), produce guidance on aspects of anti-money laundering, counter-terrorism financing, digital IDs and know your customer (KYC) standards.

Committee on Payments and Market Infrastructures have commenced work on multi-lateral service level agreements among cross-border payment schemes.

CPMI will also work on area such as liquidity bridges, interlinking of domestic payment systems for cross-border payments and harmonising API protocols.

As consultations and artefacts are produced, AusPayNet, through CBPAC, will coordinate responses and activities to ensure the Australian payments industry is represented and prepared.

Taking forward the roadmap - CPMI milestones committed for 2022

We look forward to working with you through 2022 and beyond.

Contacts:

David O’Mahony

E: domahony@auspaynet.com.au

Samantha Gilliland

E: sgilliland@auspaynet.com.au

Please reach out if you would like further information or if there are any particular topics that you would like us to cover in our future newsletters.

Appendix 1

| Wholesale | Retail (e.g. B2B, P2B/B2P, Other P2P3) | Remittances | |

|---|---|---|---|

| Cost | No Target Set | Global average cost of payment to be no more than 1%, with no corridors with costs higher than 3% by end-2027 | Reaffirm UN SDG: Global average cost of sending $200 remittance to be no more than 3% by 2030, with no corridors with costs higher than 5% |

| Speed | 75% of cross-border wholesale payments to be credited within one hour of payment initiation or within one hour of the pre-agreed settlement date and time for forward dated transactions and for the remainder of the market to be within one business day of payment initiation, by end-2027. Payments to be reconciled by end of the day on which they are credited, by end-2027. | 75% of cross-border retail payments to provide availability of funds for the recipient within one hour from the time the payment is initiated and for the remainder of the market to be within one business day of payment initiation, by end-2027 | 75% of cross-border remittance payments in every corridor to provide availability of funds for the recipient within one hour of payment initiation and for the remainder of the market to be within one business day, by end-2027 |

| Access | All financial institutions (including financial sector remittance service providers) operating in all payment corridors to have at least one option and, where appropriate, multiple options (i.e. multiple infrastructures or providers available) for sending and receiving cross-border wholesale payments by end-2027 | All end-users (individuals, businesses (including MSMEs) or banks) to have at least one options (i.e. at least one infrastructure or provider available) for sending or receiving cross-border electronic payments by end-2027 | More than 90% of individuals (including those without bank accounts) who wish to send or receive a remittance payment to have access to a means of cross-border electronic remittance payment by end-2027 |

| Transparency | All payment service providers to provide at a minimum the following list of information concerning cross-border payments to payers and payees by end-2027: total transaction cost (showing all relevant charges, including sending and receiving fees including those of any intermediaries, FX rate and currency conversion charges); the expected time to deliver funds; tracking of payment status; and terms of service. | ||