The Digital Economy: Cards dominate Australian retail payments

Our bi-annual milestones reports, entitled Digital Economy, look at the payment choices Australians make.

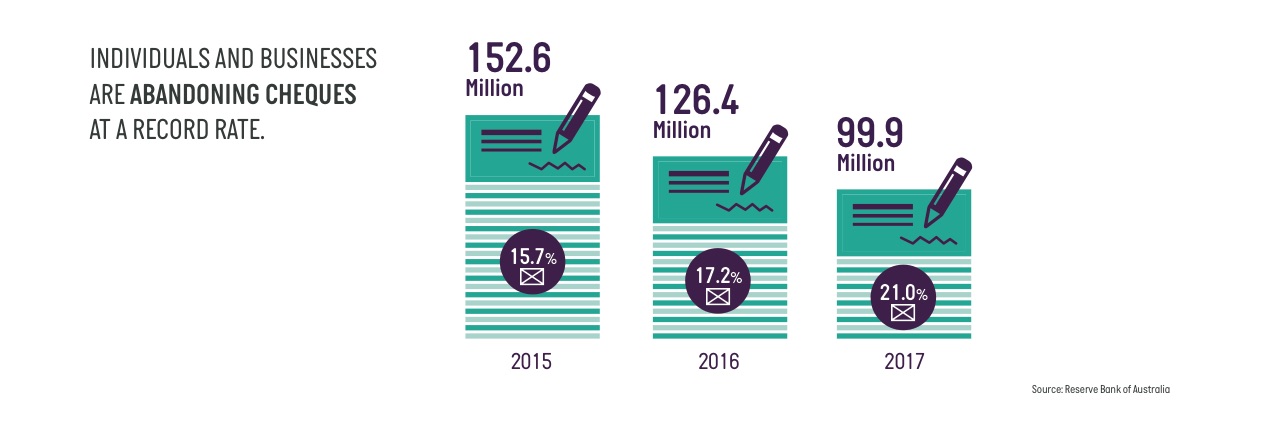

The latest report, released on 30 November 2017, reinforces that individuals and businesses are abandoning cheques and cash at a record rate as they embrace digital payments. In the 12 months to 30 June 2017, cheque use plunged 21% to dip under 100 million for the first time – the largest drop ever recorded.

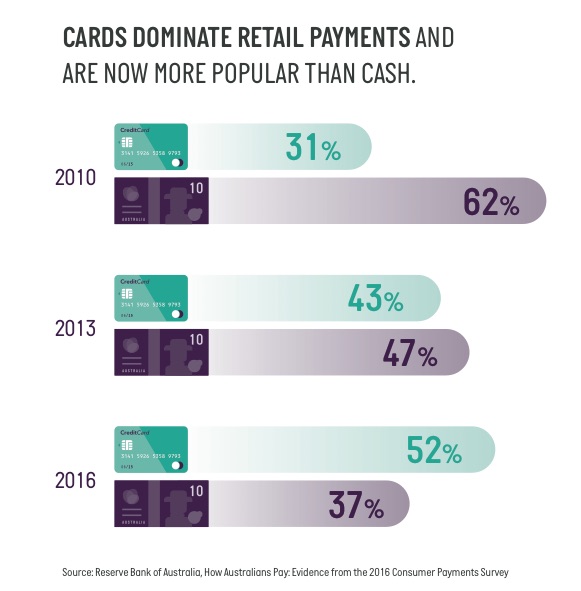

The report also shows that cash has lost its position as the dominant retail payment method, now accounting for only 37% of payments. This compares to 47% in 2013 and 62% in 2010.

This strong preference for cards is reflected in an accelerated decline in ATM withdrawals. The number of ATM withdrawals fell by 7.5% over the period, following a 6.6% drop in the previous 12 months.

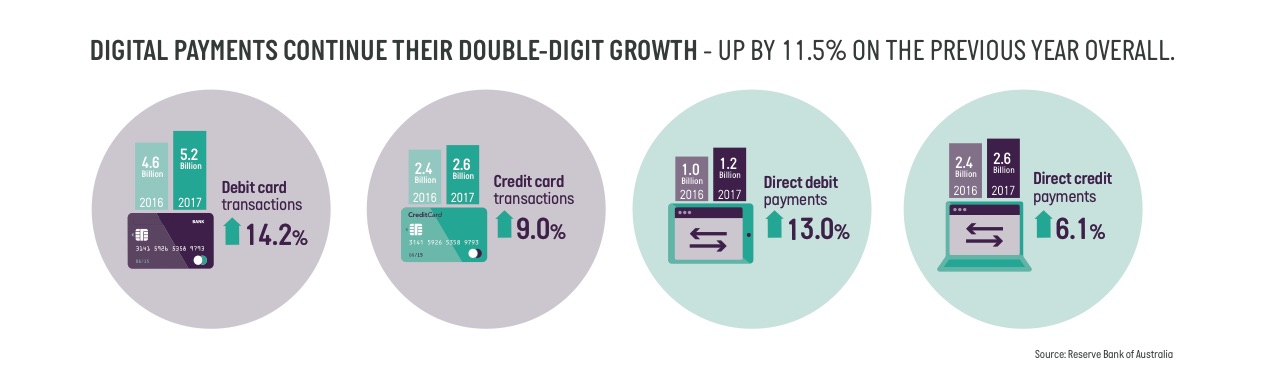

Digital payments - debit card, credit card, direct debit and direct credit transactions – continue their double-digit growth, increasing by 11.5% overall.

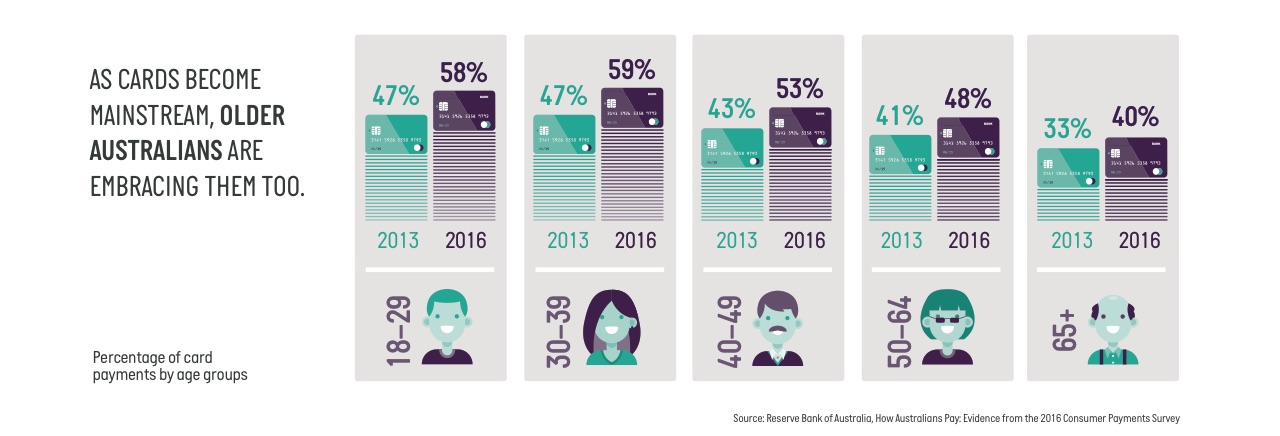

This year, for the first time, cards overtook cash as the most popular payment method, with the report showing cards are the preferred payment method across all age groups. Older Australians over 65 are embracing cards too, now using them for 40% of their payments.

Australia’s card use is enabled by one of the highest penetrations of POS devices (39,337) per million inhabitants, ahead of Canada (38,870), Italy (36,902), Singapore (33,219) and the United Kingdom (32,858). Australia also has a comparatively high smartphone penetration, estimated at 84% in 2016.

The regulatory environment is continuing to evolve to support the transition to the digital economy. The Report provides an update on the Black Economy Taskforce, open banking, and card surcharging reforms.

Click to view the full report and accompanying infographic. Please get in touch if you would like further information.