Cross-Border Payments Roundup - March 2025

Welcome

Welcome to the seventh Cross-Border Payments Round-Up, a biannual newsletter sharing updates on the progress on the G20 Roadmap for Enhancing Cross-border Payments.

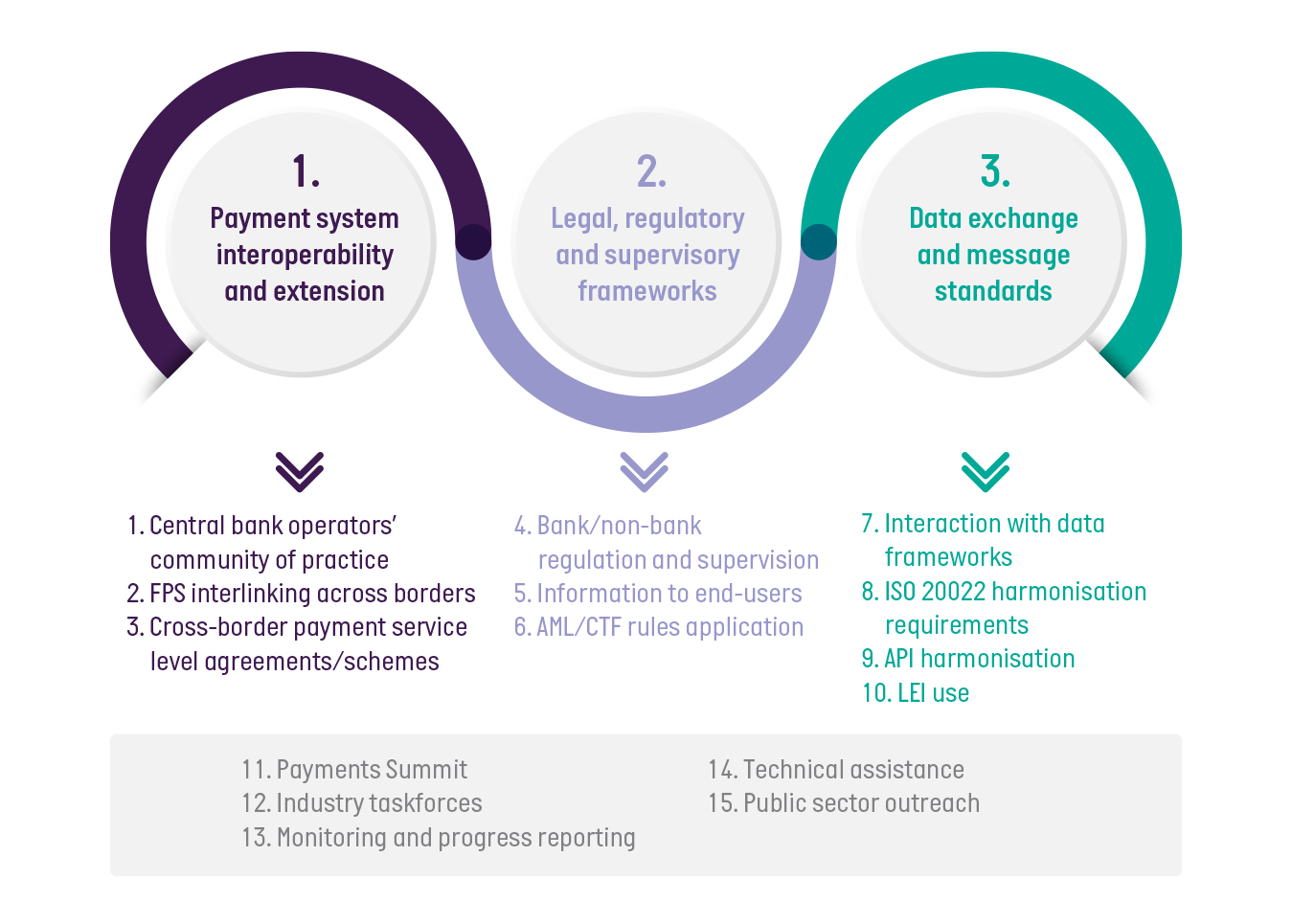

The Financial Stability Board (FSB) continues its work on ten action items across three priority themes, underpinned by five further generic actions.

Source: FSB

Cross-Border Payments Advisory Council (CBPAC)

AusPayNet’s CBPAC continues to support and coordinate industry activities that will be key to successfully implementing the roadmap and domestic cross-border payment priorities. The targets remain in place and are in Appendix 1.

General Round-Up

The FSB continues with its Work Programme for 2025. While more than half the actions under the Roadmap have been completed, the key performance indicators (KPIs) indicate that significant effort is needed to reach the Roadmap goals for faster, cheaper, more transparent and inclusive cross-border payments. The FSB will reframe its strategy to focus on identifying and addressing the challenges to implementing the Roadmap actions. It will also strengthen engagement with the private sector.

The FSB also noted – in their letter to the G20 Finance Ministers and Central Bank Governors meeting, held in February 2025 in South Africa – that continued leadership by the G20, to encourage national authorities and others to take the necessary steps at the local level, will help to achieve global progress. This is because the initiation and final receipt of cross-border payments typically involves payment systems and frameworks at the domestic level. They further noted that they would take a focus on regional developments, particularly in those jurisdictions, regions and segments most affected by frictions in cross-border payments.

In July 2024, the Bank for International Settlements' (BIS) Committee on Payments and Market Infrastructures (CPMI), together with the G7 Presidency, organised a conference to expedite the interlinking of fast payment systems (FPS). In their Communique of October 2024, the G7 Finance Ministers and Central Bank Governors reiterated their support of and commitment to a timely and effective implementation of the G20 Roadmap to enhance cross-border payments to make them faster, cheaper, more transparent, and more inclusive, while maintaining their safety, resilience, and financial integrity. They further noted that improving cross-border payments should benefit both advanced economies and emerging markets and developing economies (EMDEs), contribute to financial integration, and reduce the risk of market fragmentation.

In December, we were honoured to have Maha El Dimachki, Head of the Bank for International Settlements (BIS) Innovation Hub Singapore Centre, attend our annual Payments Summit as a guest speaker. Maha participated in a fireside chat with our CEO, Andy White, sharing insights into the work being undertaken by her team. You can revisit the Fireside Chat here.

Taskforce Progress

Payment System Interoperability and Extension (PIE) Taskforce

CPMI’s PIE Taskforce has published a webinar on their task teams’ work and planned deliverables in 2025. The last meeting of the CPMI PIE Taskforce was held in January 2025 and was the final meeting to be held with the current Member composition. CPMI is seeking to renew the PIE Taskforce by inviting market stakeholders to join.

In December 2024, CPMI, through its PIE taskforce, sought feedback from industry and other external parties on how to best enhance cross-border payments. AusPayNet provided a response to the consultation.

CPMI PIE Taskforce’s Industry Task Team 3 published their Consolidated Report: Fostering ISO 20022 Harmonisation in January 2025. This is an insightful stocktake of ISO 20022 global implementation. In addition, it evaluates the necessary updates to align with the CPMI’s harmonised ISO 20022 data requirements, assessing challenges to broad adoption, and developing proposals to address these issues.

The BIS, in partnership with CPMI, have published ‘Brief No 6; Changing the clock: practical approaches to extend payment system operating hours’. Whilst there is no current appetite in Australia for extending the operating hours of HVCS, this paper outlines the challenges, and considerations should that position change.

Legal, Regulatory and Supervisory (LRS) Taskforce

The FSB has not published any summary or action points of its LRS Taskforce since April 2024. However, the FSB did publish two papers of relevance in December 2024. The first, ‘Final report; Recommendations to Promote Alignment and Interoperability Across Data Frameworks Related to Cross-border Payments’ provides 12 recommendations such as adoption and harmonisation of ISO 20022 and adoption of the Financial Action Task Force’s (FATF) Recommendation 16 (Travel Rule). Recommendation 9 of this paper is of particular interest to Members in that it proposes that “National authorities should provide a clear and reasonable legal pathway for cross-border payments market participants to transmit across borders data related to payment processing, risk management, or fraud and financial crime prevention.”

The second paper is the ‘Final report: Recommendations for Regulating and Supervising Bank and Non-bank Payment Service Providers Offering Cross-border Payment Services’. It provides six recommendations for authorities to consider with respect to payments service providers operating in cross-border payments within their jurisdictions in order to assess risk and develop appropriate strategies to deliver consumer protections and oversight of licensing, registration and compliance with AML/CTF compliance programs.

Similar to the CPMI PIE Taskforce, in December 2024, the FSB invited firms that offer cross-border payment services and relevant industry associations to nominate senior representatives to serve on the FSB’s Taskforce on Legal, Regulatory, and Supervisory matters. AusPayNet was successful in its nomination and looks forward to working with the FSB on its implementation of its policy recommendations, as well as to addressing any other legal, regulatory and supervisory frictions that have been identified as significant impediments to achieving the goals of the G20 Roadmap.

Data Exchange and Message Standards

The FATF will be holding its Private Sector Collaborative Forum (PSCF) in Mumbai on 25-27 March 2025. This will include the uplift to Recommendation 16, Wire Transfers.

In January 2025, CPMI announced further steps to promote the adoption of its harmonised ISO 20022 data requirements for more efficient processing of cross-border payments. Firstly, CPMI will maintain the harmonised data requirements at least during the G20 cross-border payments programme until end-2027. Secondly, to support maintenance and encourage global adoption of the harmonised data requirements, CPMI will establish a joint panel with members from the ISO 20022 global market practice groups. Finally, CPMI will promote and support industry efforts to develop global ISO 20022 market practice guidelines for fast payments based on the harmonised data requirements.

Other

In terms of monitoring the KPIs that underpin the targets set out by the Roadmap, the FSB committed to reviewing the methodology annually. In December 2024, the FSB published its Annual Progress Report on Meeting the Targets for Cross-border Payments: 2024 Methodology document. The FSB has revised the methodology to calculate the speed and transparency KPIs for retail payments. The change is to the calculation methodology for speed. The FSB methodology is complex, but the change is designed to remove any skew of speed data within a corridor by a single payment service provider.

The BIS Innovation Hub continues its innovative exploratory work on cross-border payments. They have released their Interim report; Project Rialto - Improving instant cross-border payments using central bank money settlement. This Interim Report demonstrates the technical feasibility of retail cross-border payments using interlinked FPSs together with an automated foreign exchange wholesale conversion layer that allows the use of central bank money as a safe settlement asset.

We look forward to working with you through 2025.

Contact:

David O’Mahony

Email: domahony@auspaynet.com.au

Please reach out if you would like further information or if there are any specific topics that you would like us to cover in future newsletters.

Appendix 1

| Wholesale | Retail (e.g. B2B, P2B/B2P, Other P2P3) | Remittances | |

| Cost | No Target Set | Global average cost of payment to be no more than 1%, with no corridors with costs higher than 3% by end-2027 | Reaffirm UN SDG: Global average cost of sending $200 remittance to be no more than 3% by 2030, with no corridors with costs higher than 5% |

| Speed | 75% of cross-border wholesale payments to be credited within one hour of payment initiation or within one hour of the pre-agreed settlement date and time for forward dated transactions and for the remainder of the market to be within one business day of payment initiation, by end-2027. Payments to be reconciled by end of the day on which they are credited, by end-2027. | 75% of cross-border retail payments to provide availability of funds for the recipient within one hour from the time the payment is initiated and for the remainder of the market to be within one business day of payment initiation, by end-2027. | 75% of cross-border remittance payments in every corridor to provide availability of funds for the recipient within one hour of payment initiation and for the remainder of the market to be within one business day, by end-2027 |

| Access | All financial institutions (including financial sector remittance service providers) operating in all payment corridors to have at least one option and where appropriate, multiple options(i.e. multiple infrastructures or providers available) for sending and receiving cross-border wholesale payments by end-2027 | All end-users (individuals, businesses (including MSMEs) or banks to have at least one options (i.e. at least one infrastructure or provider available) for sending or receiving cross-border electronic payments by end 2027 | More than 90% of individuals (including those without bank accounts) who wish to send or receive a remittance payment to have access to a means of cross-border electronic remittance payment by end-2027 |

| Transparency | All payment service providers to provide at a minimum the following list of information concerning cross-border payments to payers and payees by end-2027: total transaction cost (showing all relevant charges including sending and receiving fees including those of any intermediaries, FX rate and currency conversion charges); the expected time to deliver funds; tracking of payment status; and terms of service. | ||

Source: FSB

Note:

Wholesale Payment: Has a value threshold of US$100,000 or greater

Retail Payment: Has a value threshold of less than US$100,000 but greater than US$200

Remittance Payment: Has a value threshold of US$200 or below