The eConveyancing Payments Industry Code

18 September 2024

By Andy Leigh, Senior Business Analyst, AusPayNet

What is eConveyancing?

Conveyancing is, put simply, the transfer of interests in land between two parties. This usually involves both a lodgment step involving the relevant Titles Office(s) (for example, the registering of a mortgage or transfer of ownership), and a financial settlement step (a payment).

For over a decade, it has been possible for conveyancers in some jurisdictions to perform some conveyancing transactions online, using an Electronic Lodgment Network (ELN) operated by PEXA, an Electronic Lodgment Network Operator (ELNO). A second ELNO, Sympli, was launched in 2018 and the types of conveyancing transactions that can be completed through eConveyancing have consistently grown. So too have the jurisdictions in which eConveyancing can be undertaken: eConveyancing is now mandatory in New South Wales, Victoria, South Australia and Western Australia; is available for certain transactions in Queensland, the Australian Capital Territory and Tasmania; and plans are in place for eConveyancing to be available in the Northern Territory.

In June 2022, an amendment to the Electronic Conveyancing National Law (ECNL) came into being, to support competition in the eConveyancing marketplace, requiring ELNOs to be interoperable (i.e. to work together effectively to complete an eConveyancing transaction.)

History of the eConveyancing Payments Industry Code

The ECNL specifies that the lands title Registrars are not responsible for regulating ‘Associated Financial Transactions’, the payment-related financial settlement which forms part of an overall eConveyancing transaction.

Linked to the changes in ECNL to support interoperability, AusPayNet was asked by the Council of Financial Regulators (CFR) to create an industry framework covering the regulation of the financial settlement aspects of eConveyancing transactions (the Code).

Working closely with our members and the ELNOs, PEXA and Sympli, and with support from the Australian Registrars National Electronic Conveyancing Council (ARNECC), AusPayNet developed this Code, which was approved by our Board on 31 August 2023.

ARNECC is now consulting on updating its Model Operating Requirements to introduce requirements for ELNOs to become a member of and comply with the Code.

Benefits of the Code

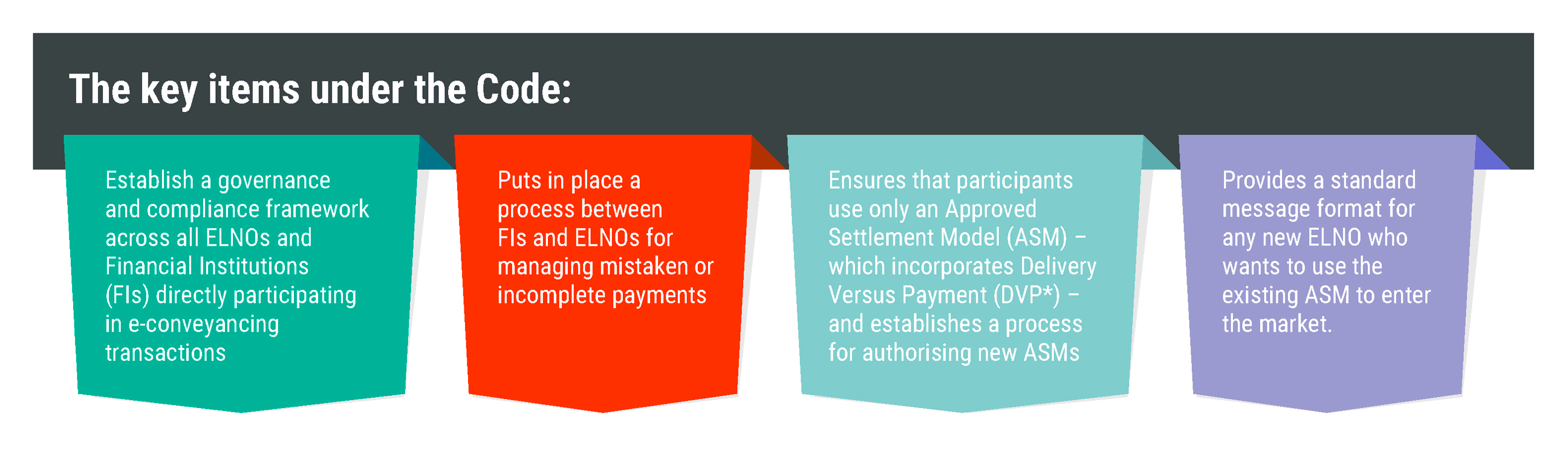

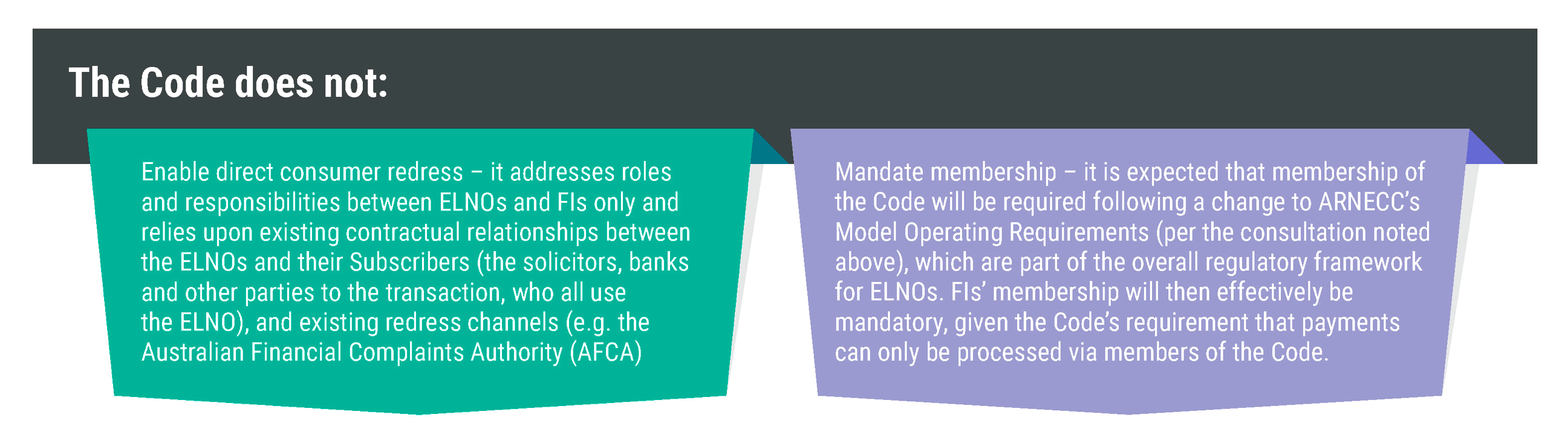

The Code provides standardisation of relevant parts of the financial settlement process for both interoperable (multiple ELNO) and single-ELNO eConveyancing transactions.

|

|

*DVP – this is the concept where both the lodgment and financial steps must occur together and be irrevocable, or neither step occurs. When DVP is followed, there is no possibility of an error in a transaction resulting in one of the parties having both the money and the title to a particular property.

The Code aims to achieve the CFR’s objectives of promoting payments interoperability, security, trust and competition in the eConveyancing industry.

Next steps

AusPayNet is currently working with ARNECC to plan the standing up of the Code and to establish the relevant governance structures ahead of the Code becoming effective.

For more information, please email info@auspaynet.com.au with the subject title “eConveyancing Payments Industry Code”.