Cross-Border Payments Round-Up - April 2023

Welcome

Welcome to the third Cross-Border Payments Round-Up, a biannual newsletter sharing updates on the progress of the global roadmap for enhancing cross-border payments.

Since the consultation on the Financial Stability Board's (FSB) 'Targets for addressing the four challenges of cross-border payments' in 2021, AusPayNet's Cross-Border Payments Advisory Council (CBPAC) has coordinated the submission of a significant number of consultation responses and has continued engaging both the FSB and Committee on Payments and Market Infrastructures (CPMI).

The New FSB Priorities

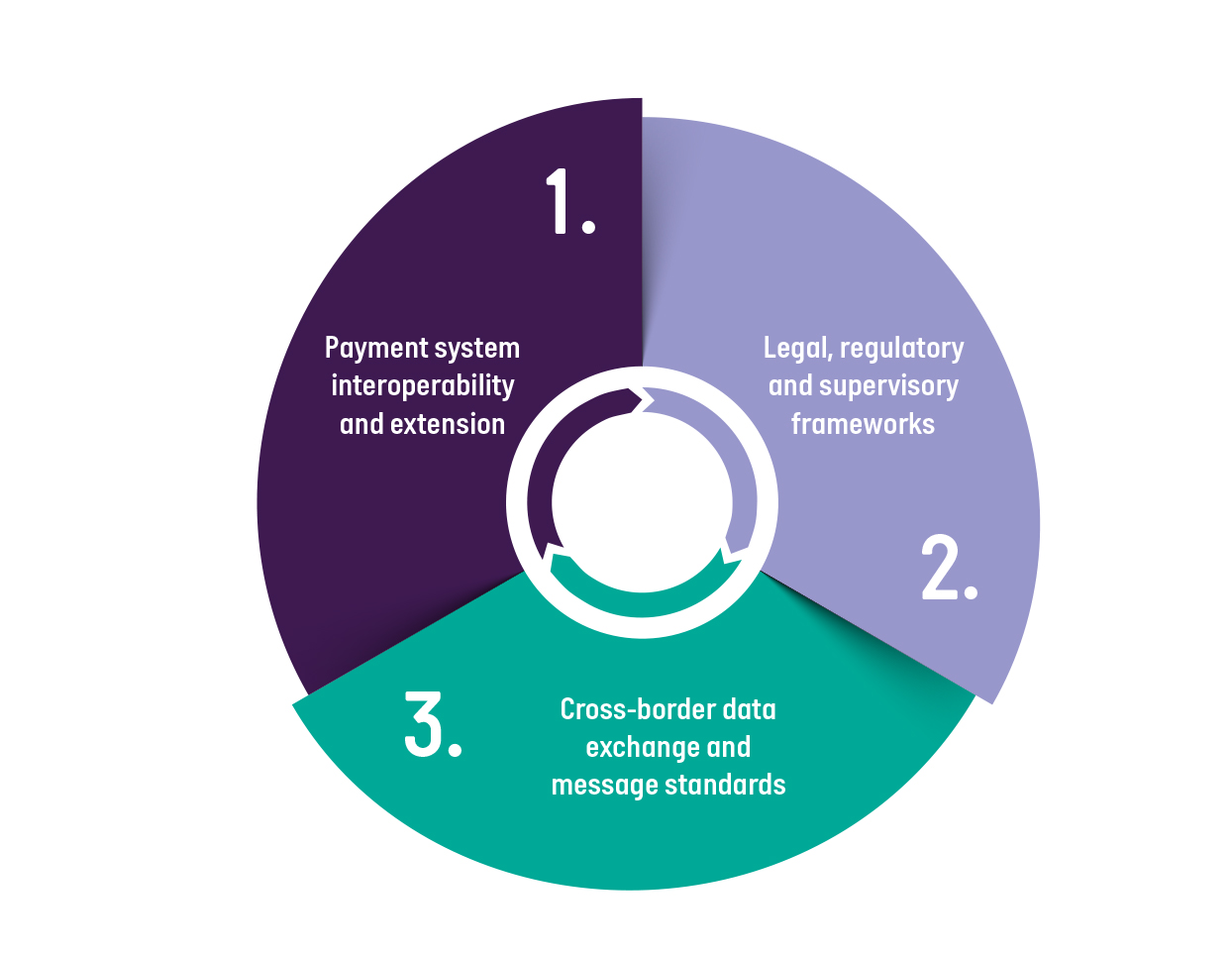

The FSB has reached an inflection point after two years of stocktakes, consultations and analyses. In its note to the G20 Leaders in October 2022, 'G20 Roadmap for Enhancing Cross-border Payments', the FSB sought endorsement of its 'Priorities for the next phase of work'. These priorities are:

Source: FSB

These priorities encompass improvements to underlying systems and arrangements, and the development of new systems with coordination between, and the commitment of, public authorities and the private sector.

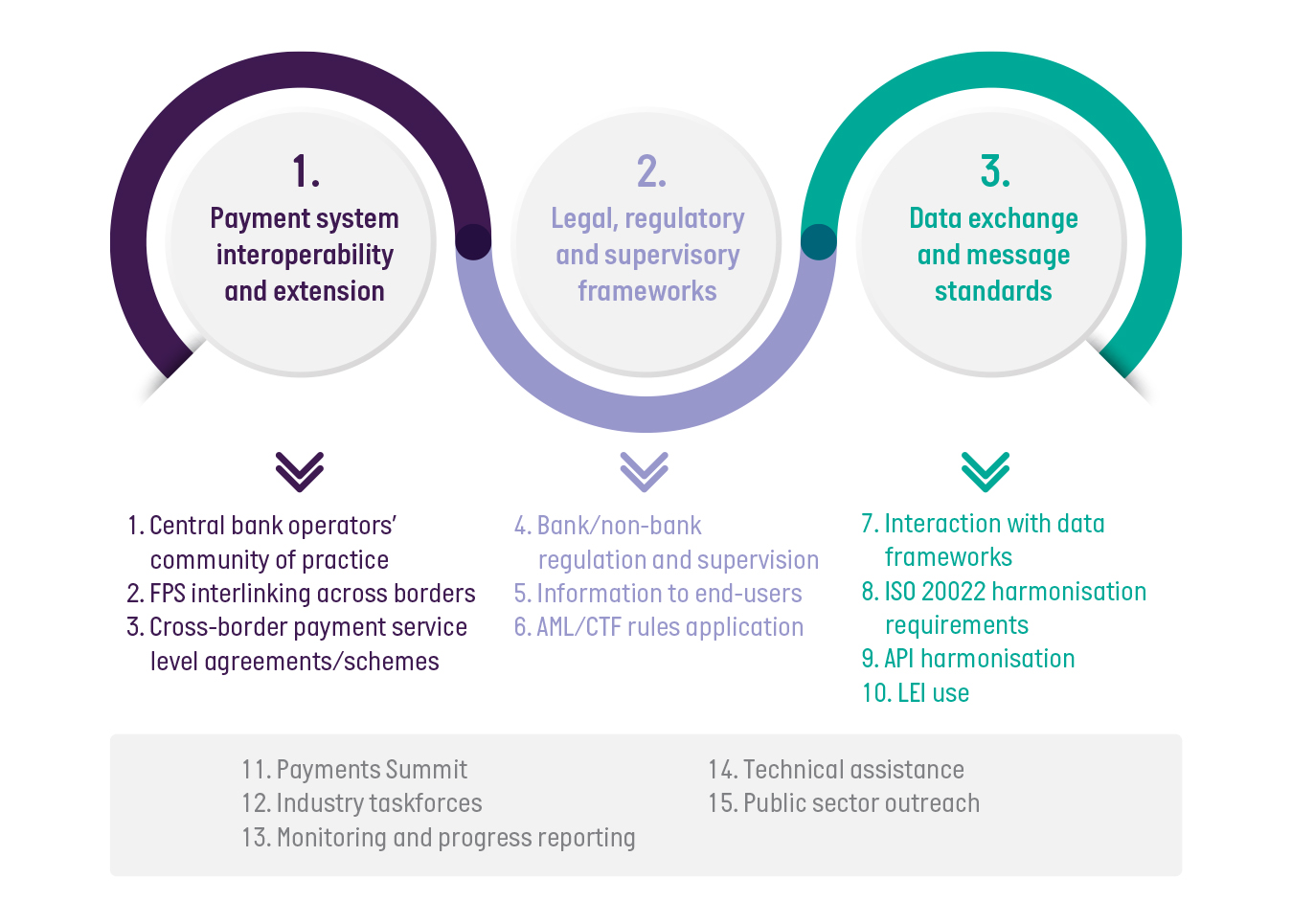

To actualise this, the FSB published its 'G20 Roadmap for Enhancing Cross-border Payments: Priority actions for achieving the G20 targets' in March 2023. This is a comprehensive refocusing of the original Roadmap from 2021 and assigns 10 actions across three priority themes, underpinned by five further generic actions. This approach was endorsed by the G20 Finance Ministers and Central Bank Governors Meeting in Bengaluru, India in February 2023. These actions are set out in the diagram below.

Source: FSB

In recognition of the FSB's changes, this Cross-Border Payments Round-Up and future newsletters will be structured to focus on actions undertaken with respect to each priority theme.

What remains constant though are the targets for addressing the four challenges of cross-border payments, which the G20 has agreed with the FSB - speed, cost, transparency and access - set out in Appendix 1. However, there have been some changes to the definitions of wholesale and retail payments that are discussed later in the Round-Up.

Cross-Border Payments Advisory Council

AusPayNet's CBPAC continues to support and coordinate industry activities that will be key to successfully implementing the roadmap and domestic cross-border payment priorities.

Priority theme progress

- Payment System Interoperability and Extension

In February, the CPMI published its technical report, 'Operational and technical considerations for aligning payment system operating hours for cross-border payments: An analytical framework'. This report provides an analytical framework for central banks and real-time gross settlement (RTGS) operators to assist with planning an extension of RTGS hours.

Australia is uniquely placed in having the New Payments Platform (NPP), which will begin supporting the international payments as part of its International Payments Business Service from December 2023 for NPP Participants, with extension to NPP-Identified Institutions in April 2024. This service will enable the processing of the final domestic leg of an inbound international payment, and, operating 24/7, will improve the speed of international payments significantly.

In his keynote address at AusPayNet's 2022 Summit, Philip Lowe, Governor of the RBA, said that the RBA is planning to work with the Australian payments industry to study the economic, business and technical issues involved with linking NPP with real-time payments systems elsewhere in the world. To further support this, the Bank for International Settlements Innovation Hub will be moving its Project Nexus to phase three, which will finalise the Nexus technical blueprint to enable multilateral linking of Fast Payment Systems (FPS).

- Legal, Regulatory and Supervisory Frameworks

The Financial Action Task Force (FATF) has established a Private Sector Consultative Forum. A forum on digital transformation and payment transparency will be held in Vienna, Austria on 8-9 May 2023.

An additional forum to discuss Recommendation 16 of the FATF Recommendations is slated for later this month.

- Cross-Border Data Exchange and Message Standards

CPMI recently released its consultative report, 'ISO 2022 harmonisation requirements for enhancing cross-border payments'. AusPayNet is consulting broadly with the industry in constructing its response and is leveraging its program management of the recent HVCS ISO 20022 migration.

Of further interest, CPMI will be convening payment system operators and market practice industry groups to align market practice guidelines with the ISO 20022 harmonisation requirements through the course of 2023/24.

Additionally, CPMI has indicated that payment system operators supporting the adoption of the harmonised version of ISO 20022 are to set out publicly their commitment to adopt that standard for cross-border payments.

- Generic Underpinning Actions

As part of the Industry Taskforces action item, both CPMI and the FSB have established new taskforces to assist them in taking forward the G20 Roadmap for Enhancing Cross-border Payments.

CPMI has established the Payments Interoperability and Extension (PIE) Taskforce. This will bring together firms that offer cross-border payment services, payment system operators and relevant industry associations.

The PIE Taskforce should provide a source of expert advice and a mechanism for collaboration on the provision and enhancement of cross-border payment arrangements. It should also serve as a forum for the exchange of implementation experiences and coordination between public authorities and private sector stakeholders.

FSB has established the Legal, Regulatory, and Supervisory Matters (LRS) Taskforce. This will bring together firms that offer cross-border payment services, payment system operators and relevant industry associations with significant experience and responsibilities in compliance, legal, risk management and cross-border payment operations.

The LRS Taskforce will provide input and feedback on frictions in legal, regulatory or supervisory frameworks related to the provision of cross-border payments and relevant data-related frameworks.

The FSB also published its Final Report, 'Developing the Implementation Approach for the Cross-Border Payments Targets', in November 2022. While the targets remain unchanged - as set out in Appendix 1 - the FSB has flagged adjustments to the definition of wholesale and retail market segments. The adjustment is to include all payments above a certain value in the wholesale market, regardless of the type of end-user involved. The value threshold will be published by the FSB at a later date.

Taking the roadmap forward

We note APEC's continuing interest in supporting cross-border payments and remittances, as set out in the Chair's Statement of the 29th APEC Finance Ministers' Meeting, which was held in Bangkok, Thailand in October 2022.

The Bank for International Settlements (BIS), CPMI, BIS Innovation Hub, International Monetary Fund (IMF) and World Bank Group published a paper on 'Exploring multilateral platforms for cross-border payments' in January 2023. It provides an analysis of the potential costs and benefits of existing and potentially new platforms and how they might alleviate some of the cross-border payment frictions. It also evaluates the risks, barriers, and challenges to establishing multilateral platforms, and explores two paths for their organic evolution, which are:

- increasing the role of existing multilateral platforms, and

- increased public sector involvement in overcoming risk and barriers to the creation of new multilateral platforms.

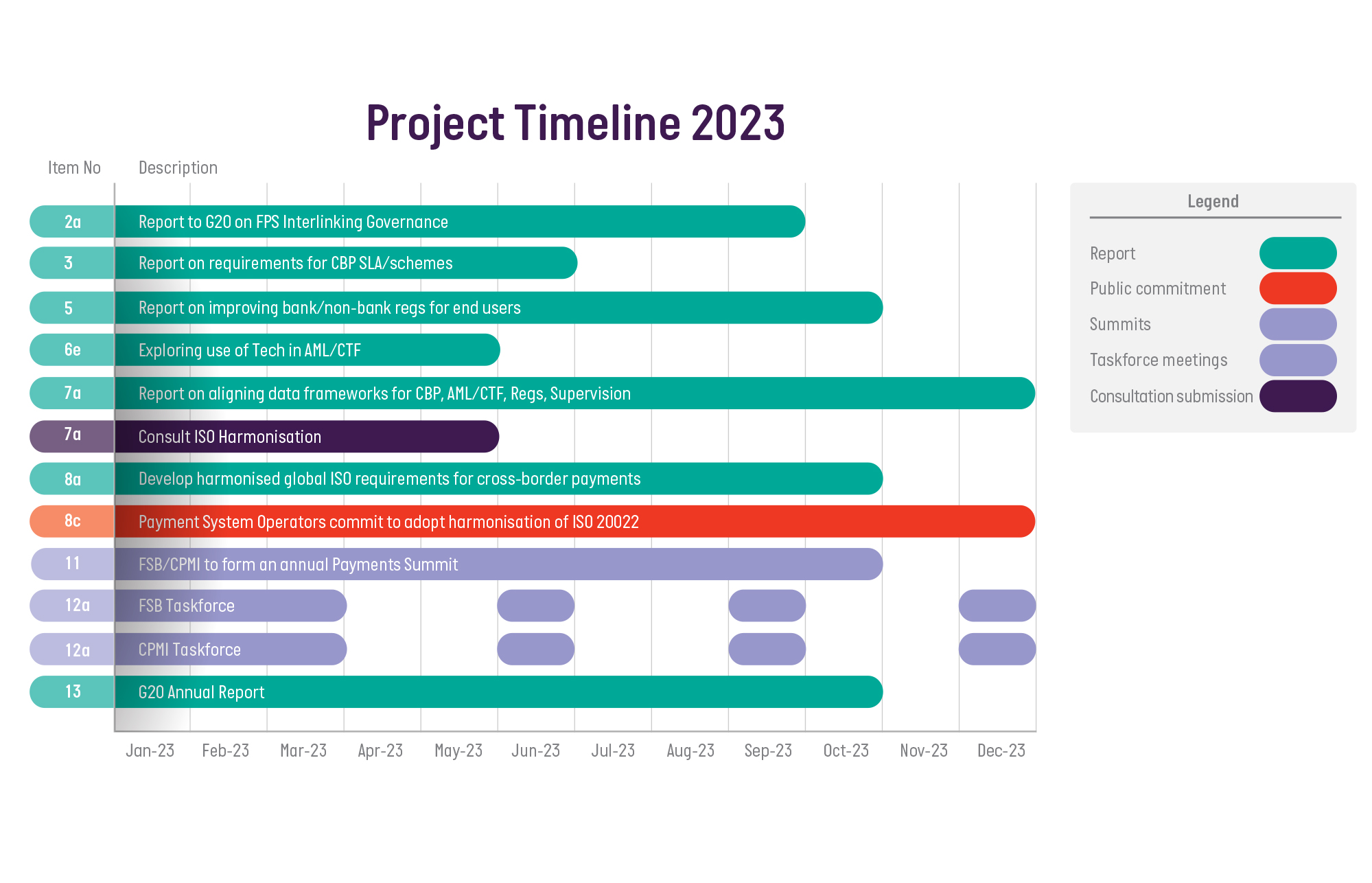

CPMI and FSB Milestones for 2023

We look forward to working with you through 2023.

Contact:

David O’Mahony

Email: domahony@auspaynet.com.au

Please reach out if you would like further information or if there are any particular topics that you would like us to cover in future newsletters.

Appendix 1

| Wholesale | Retail (e.g. B2B, P2B/B2P, Other P2P3) | Remittances | |

|---|---|---|---|

| Cost | No Target Set | Global average cost of payment to be no more than 1%, with no corridors with costs higher than 3% by end-2027 | Reaffirm UN SDG: Global average cost of sending $200 remittance to be no more than 3% by 2030, with no corridors with costs higher than 5% |

| Speed | 75% of cross-border wholesale payments to be credited within one hour of payment initiation or within one hour of the pre-agreed settlement date and time for forward dated transactions and for the remainder of the market to be within one business day of payment initiation, by end-2027. Payments to be reconciled by end of the day on which they are credited, by end-2027. | 75% of cross-border retail payments to provide availability of funds for the recipient within one hour from the time the payment is initiated and for the remainder of the market to be within one business day of payment initiation, by end-2027 | 75% of cross-border remittance payments in every corridor to provide availability of funds for the recipient within one hour of payment initiation and for the remainder of the market to be within one business day, by end-2027 |

| Access | All financial institutions (including financial sector remittance service providers) operating in all payment corridors to have at least one option and, where appropriate, multiple options (i.e. multiple infrastructures or providers available) for sending and receiving cross-border wholesale payments by end-2027 | All end-users (individuals, businesses (including MSMEs) or banks) to have at least one options (i.e. at least one infrastructure or provider available) for sending or receiving cross-border electronic payments by end-2027 | More than 90% of individuals (including those without bank accounts) who wish to send or receive a remittance payment to have access to a means of cross-border electronic remittance payment by end-2027 |

| Transparency | All payment service providers to provide at a minimum the following list of information concerning cross-border payments to payers and payees by end-2027: total transaction cost (showing all relevant charges, including sending and receiving fees including those of any intermediaries, FX rate and currency conversion charges); the expected time to deliver funds; tracking of payment status; and terms of service. | ||

Source: FSB: 'Developing the Implementation Approach for the Cross-Border Payments Targets'